Structural Business Statistics 2020

Varying developments in the business sector in the first year of the pandemic

Statistical news from Statistics Sweden 2022-05-04 8.00

The enterprises in the business sector reduced their value added by 2.6 percent, and net turnover by 3.0 percent between 2019 and 2020. There was a large variation between industries. The industry for airlines decreased net turnover by 51.5 percent, and operating margin with 21 percentage points to -22.7 percent in 2020. The industry for pharmaceuticals on the other hand, increased their net turnover by 43.4 percent and had a continued high operating margin (28.1 percent).

The business sector consisted in 2020 of 1 176 000 enterprises with 2 869 000 employees. Total net turnover amounted to SEK 9 204 billion and total assets were SEK 21 845 billion. Value added decreased by 2.6 percent to SEK 2 696 billion compared to 2019. Goods producing enterprises decreased their value added by 4.9 percent to SEK 980 billion and service producing enterprises decreased by 1.2 percent to SEK 1 710 billion.

The share of fixed costs increased from 27.4 to 27.9 percent in the total business sector. Industry sections Administrative and support service activities (N) and Arts, entertainment, and recreation (R) increased the share of fixed costs with 6.1 and 6.8 percent respectively compared to 2019. This may be due to enterprises having managed to reduce their variable costs during the Corona pandemic.

An effect of the pandemic is clearly shown on return on equity for the goods producing enterprises, where returns decreased by 4.6 percentage points to 9.4 percent in 2020. Services enterprises also declined their return on equity, but only with 0.8 percentage points to a return of 12.8 percent. Both sectors, on the other hand, strengthened the cash liquidity. Services enterprises increased cash liquidity with 3.1 percentage points to 111.4 percent, and the goods producing enterprises increased with 2.5 percentage points to 108.7 percent. A positive contribution to the cash liquidity in 2020 were probably the governmental subsidies granted, and paid, to enterprises during the pandemic.

The industry for Airlines crash-landed

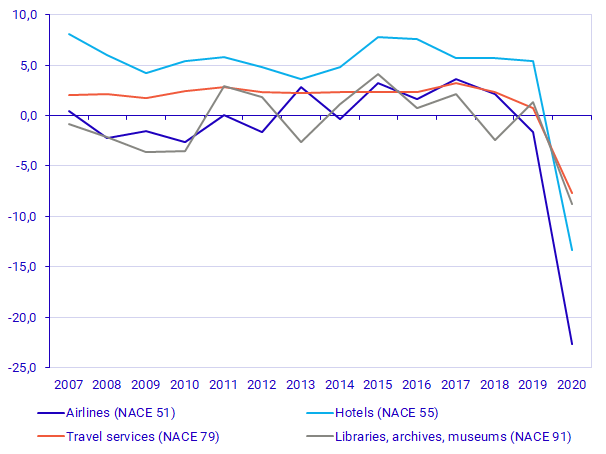

The Corona pandemic affected some industries very negatively. Among these were Airlines (NACE 51), Hotels (NACE 55), Travel services (NACE 79) and Libraries, archives, and museums (NACE 91). These industries lost a large part of their operations. Net turnover for airlines halved (minus 51.5 percent), and hotels decreased by 40.3 percent compared to 2019. Travel services were the industry group that lost the most in net turnover, with a decrease of 60.4 percent, while libraries, archives and museums decreased by 29.4 percent.

For the enterprises that showed a negative development of net turnover during the first year of the Corona pandemic, the effects are also visible in the operating margin. All these industries have during the period 2007 – 2020 had relatively low margins (below 10 percent), which have decreased drastically in 2020 because of the pandemic.

Due to restrictions, less people travelled, and the airlines showed the largest decrease, and the lowest value, in the operating margin. In 2020 the operating margin for the airline industry were -22.7 percent. Until 2019 the margin was between -2.6 percent and 3.6 percent in this industry. During the period 2010-2018, the enterprises in travel services showed a stable operating margin between 2 and 3 percent. For 2020, operating margin was -7.7 percent for the travel industry.

During the period 2007 - 2020, enterprises in the hotel industry had the highest operating margin, between 3.6 and 8.1 percent. This industry was also affected by the pandemic and the operating margin decreased to -13.3 percent for 2020. The library, archive and museum industry were also negatively affected by the pandemic and had an operating margin of -8.7 percent for 2020.

There were also industries that had a positive development during the first year of the pandemic. The Pharmaceutical industry (NACE 21) increased net turnover by 43.4 percent, Other manufacturing industries (NACE 32) increased by 13.5 percent, Research and Development (NACE 72) increased by 16 percent and Veterinarians (NACE 75) increased their net turnover by 14.5 percent in 2020 compared to 2019.

The industries with a positive development of net turnover, had a varying development of the operating margin. Other manufacturing industries increased the operating margin by just over 7 percentage points to 19.8 percent, and veterinarians increased by just under 3 percentage points to 11.0 percent. The pharmaceutical industry decreased marginally to a continued high operating margin of 28.1 percent, while enterprises in research and development decreased an already low margin to -8.2 percent.

Definitions and explanations

Structural Business Statistics is the only survey that is based on the annual accounts of all non-financial enterprises in Sweden.

All information in this item of statistical news is reported in current prices. All comparisons have been made with final data for 2019.

Net turnover: Net turnover excluding excise taxes and merchanting.

Value added: Actual production minus costs for purchased goods and services, except salaries, payroll taxes and the costs of goods for resale (because only the trade margin for these is included in the production value). Value added can also be referred to as the contribution to GDP (gross domestic product).

In this final version of data for 2020, value added is calculated using a more exhaustive method compared to the calculation of value added in the preliminary data published in December 2021.

Employees: Average number of employees, full-time equivalents: two half-time employees are counted as one full-time employee.

Assets: Sum of intangible, tangible and financial fixed assets, and sum of current assets.

Fixed costs: Costs for leasing and short-term rentals, freight and transports, rent for premises, repair and maintenance costs for machinery and equipment as well as premises, buildings and installations, energy costs incl. heating, cooling and lighting, telecommunications, salaries and other allowances, statutory social security contributions, payroll taxes and costs for depreciation of intangible and tangible fixed assets.

Return on equity: Profit/loss after financial items in relation to adjusted equity. Adjusted equity consists of equity plus 78.6 percent of untaxed reserves.

Cash liquidity: Current assets (excl. inventories) divided by short-term liabilities.

Operating margin: Profit/loss after depreciations, but before financial items in relation to net turnover.

Business sector: Enterprises conducting business activities in Sweden regardless of legal form. Businesses with financial activities and housing cooperatives are not included in the Structural Business Statistics. Public administration activities are also not included.

NACE Rev2.: Industrial classification for classifying enterprises into industries according to the activity they conduct. The Swedish equivalent is SNI2007 (Svensk näringsgrensindelning).

Goods-producing enterprises: Comprises industries 01-43 according to NACE Rev.2.

Services producing enterprises: Comprises industries 45-96 (excl. 64-66, and 84) according to NACE Rev.2.

Next publishing will be

The next item of statistical news in this series is scheduled for publication on 2022-12-07 at 08:00.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.