Environmental accounts - Environmental taxes 2021 and industry allocated environmental taxes 2020

Environmental tax revenues increased in 2021

Statistical news from Statistics Sweden 2022-06-16 8.00

In 2021, environmental tax revenue amounted to SEK 103 billion which is an increase with almost SEK 4 billion compared with the previous year. Energy taxes contribute most to environmental taxes. Households pay most of the revenue from the carbon and energy tax.

Sweden’s total environmental tax revenue amounted to SEK 103 billion in 2021. This corresponds to 2 percent of Swedish GDP. In 2021 governmental tax revenues from environmental taxes increased with almost SEK 4 billion compared with 2020. Tax revenues increased mainly from the energy tax on fuels, carbon dioxide tax and vehicle tax. Two new environmental taxes were introduced in the middle of 2020, the waste incineration tax and the tax on plastic carrier bags. Tax revenues from these taxes also increased in 2021, since 2021 is the first year they are applied to the whole calendar year.

Between 1993 and 2021 the environmental tax revenue has more than doubled. However, as a percentage of GDP and total taxes, environmental tax revenue has a decreasing trend since 1993. This indicates that environmental taxes are not increasing at the same speed as other parts of the economy and total taxes.

The COVID-19 pandemic has affected the amount of revenues from some environmental taxes during 2020 and 2021, such as the tax on air travel which decreased due to reduced air travel.

* GDP and total taxes figures are preliminary.

Energy taxes contribute most to environmental taxes

The environmental taxes are divided into energy, transport, pollution and natural resources categories. Energy taxes contributes the most to the environmental taxes. They accounted for 75 percent of total environmental taxes in 2021. Energy taxes are for example energy tax on fuel, carbon dioxide tax and energy tax on electricity. Thereafter comes transport taxes which for example are vehicle tax, congestion tax and tax on air travel. Transport taxes accounted for 22 percent of total environmental tax revenue in 2021.

Environmental tax revenues from households are unchanged 2020

The last reference year for the industry allocated environmental taxes is 2020. Taxes can be broken down by paying sector such as business sector, households and public sector. No large variations in tax revenues can be noticed between the sectors when comparing 2020 with 2019. Environmental tax revenues were in total 1 percent lower in 2020 compared with 2019.

In 2020 environmental tax revenues from households were largely unchanged compared with the previous year. Environmental tax revenues from the business sector decreased with 1 percent. This is mainly because of lower revenues from agriculture, forestry and fishery, the services sector and transport industry. In the agriculture, forestry and fishery industry, revenues decrease mainly from the carbon tax, which coincides with higher tax reductions for certain fuel use in this industry. Lower tax revenues can also be a result of lower fuel use, which contributes to the decrease both for agriculture, forestry and fishery as well as the transport industry.

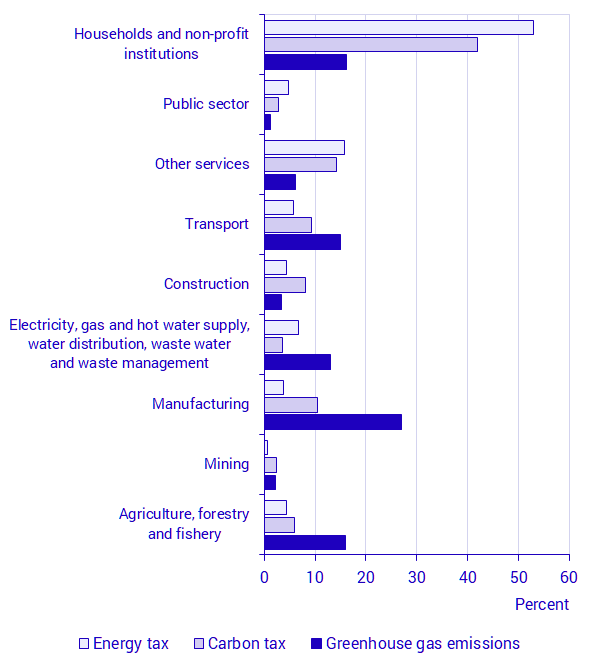

Households contribute the most towards carbon and energy tax revenues

Households paid 43 percent of the carbon tax and 48 percent of the energy tax during 2020, while only accounting for 18 percent of Sweden’s greenhouse gas emissions that year. Meanwhile, the manufacturing sector emitted 27 percent of Sweden’s greenhouse gas emissions in 2020 but only paid 10 percent of the carbon tax and 7 percent of the energy tax. This is due to tax exemption rules for the manufacturing sector.

Revisions

The industry allocation of individual and total taxes have been revised since the last publication. Regarding total environmental tax revenues, only reference year 2020 has been revised, which were preliminary last publication. Environmental tax revenues for 2020 have been revised upward with 1 percent.

For more information on which revisions have been made, see the Environmental Accounts product page under the heading Documentation (only available in Swedish)

Definitions and explanations

Environmental taxes

Den definition av en miljöskatt som används vid SCB är utarbetad av Eurostat och OECD. Den återfinns i den globala statistiska standarden för miljöräkenskaper SEEA Central Framework och möjliggör komparativa studier mellan olika länder. Eurostats definition av en miljöskatt lyder:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in ESA as a tax."

Enligt definitionen är det alltså skattebasen som avgör om skatten är en miljöskatt, inte dess motiv eller namn. ESA avser European System of Accounts och avser riktlinjerna för beräkning av nationalräkenskaper.

European statistics

Next publishing will be

The next publication on the industry allocated environmental taxes to 2021 will take place in 2023.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.