Financial accounts first quarter 2020

Non-financial corporations borrowed SEK 72 billion from banks

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2020-06-17 9.30

The Riksbank provided Swedish banks with liquidity and purchased bonds in view of the coronavirus pandemic in the first quarter of 2020. Non-financial corporations borrowed SEK 72 billion net from banks.

In the first quarter of 2020, the Riksbank decreased its holdings in foreign bonds by SEK 87 billion to facilitate better conditions to further strengthen liquidity in the Swedish financial market. During the quarter, the Riksbank provided support to banks with cash and cash equivalents by lending SEK 142 billion.

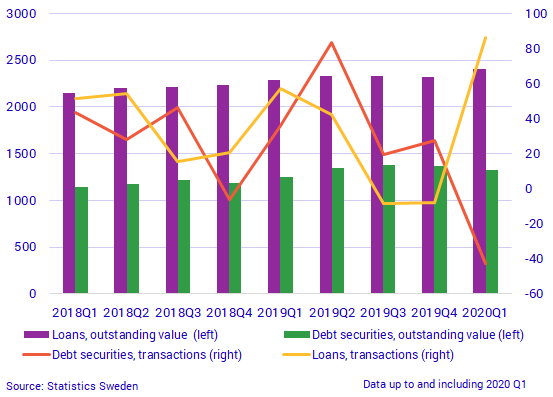

At the end of the first quarter of 2020, non-financial corporations’ loans in monetary financial institutions amounted to SEK 2 405 billion. Debt securities issued amounted to SEK 1 330 billion. Since the 1990s, borrowing in debt securities has increased as a share of financing. However, since the third quarter of 2019, loans have increased as a source of financing. In the first quarter of 2020, non-financial corporations borrowed SEK 86 billion via monetary financial institutions, of which SEK 72 billion through banks. Borrowing in debt securities decreased by SEK 43 billion in the same period.

Banks increasingly hold mortgage bonds

In the first quarter of 2020, issued mortgage bonds amounted to SEK 86 billion net, issues minus maturity and repurchase. This is considerably more than in the second half of 2019, but lower than in the first quarter a year ago, when mortgage bonds amounting to SEK 128 billion net were issued. At the time, there was great interest among foreign investors, but the first quarter of 2020 gave a different picture, and the share of foreign owners dropped by almost four percentage points in a year, from 41 percent to 37 percent. The bank sector was the sector to increase holdings in mortgage bonds the most in the past year, from 14 percent to 20 percent.

To provide support, the Riksbank purchased mortgage bonds for the first time ever. In all, at the end of the first quarter 2020, issued mortgage bonds amounted to SEK 2 181 billion and Riksbank holdings amounted to SEK 10 billion.

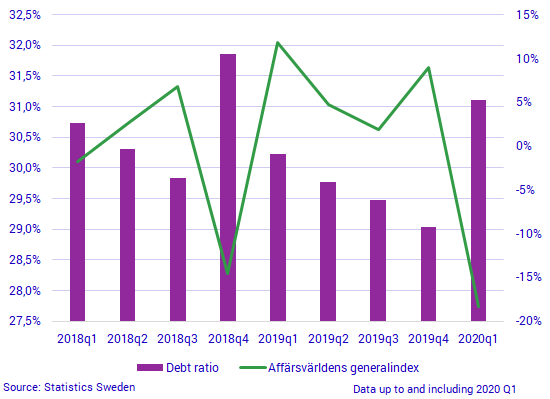

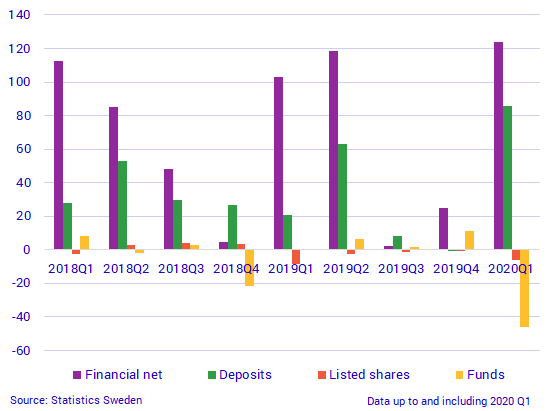

Sharp drop in households’ financial assets

In the first quarter 2020, households’ financial assets fell by 7 percent, which is the largest decline since the start of the time series. At the same time as the value of households’ financial assets dropped, liabilities increased by SEK 46 billion, which led to a larger debt ratio. The debt ratio is measured as households’ liabilities in relation to their financial assets. As a large part of the financial assets are related to the share price, these are affected by the developments on the stock market, which normally means an larger debt ratio during a major drop in the stock market.

Households’ loans, which mainly consist of loans in banks and housing credit institutions, as well as student loans, amounted to SEK 4 483 billion at the end of the first quarter of 2020. During the past four quarter, the annual growth rate for loans has hovered around 5 percent. In the last quarter, the growth rate noted a weak increase from 4.9 percent to 5.1 percent.

Revisions

In connection with the publication of the Financial Accounts 2020, first quarter, the Financial Accounts have changed the source of non-financial corporations’ borrowing and lending, and corporate loans abroad. Previously, this source was the balance statistics survey (BAST), but this has now transitioned to the balance statistics toward foreign countries survey (BB-BAST), which is also used by the Balance of Payments. This has been applied for the period Q1 2018 to Q1 2020, but will be introduced for the whole time series in the September publication. In addition, the delivery from financial market statistics has been supplemented with information on bank investments in foreign central banks to better agree with the Balance of Payments. These improvements form part of the ongoing efforts to minimise the discrepancies between the Financial Accounts and the Balance of Payments.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they comprise of the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

More information: the National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thereby consistent with the values published in the Financial Accounts.

For more information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publication on 2020-09-22 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.