Financial accounts fourth quarter 2019

High levels of household savings in the fourth quarter

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2020-03-19 9.30

Households’ financial savings amounted to SEK 20 billion in the fourth quarter of 2019, a high rate for a fourth quarter. Households’ financial wealth increased by SEK 384 billion in total.

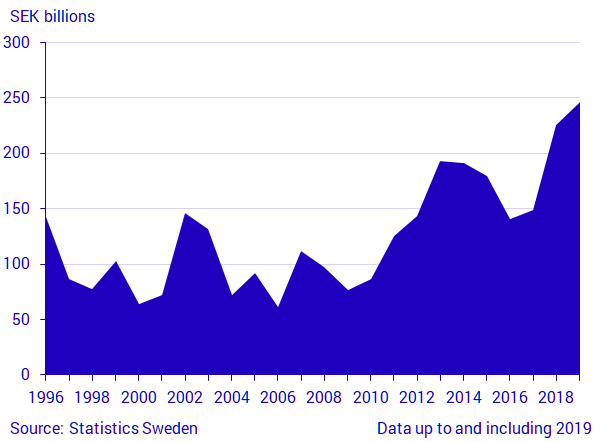

Financial savings in the household sector amounted to SEK 20 billion in the fourth quarter, the highest level of savings in the fourth quarter in six years. Net purchases of tenant ownership rights and investment funds were the main contributors to savings and amounted to SEK 22 billion and SEK 9 billion respectively. For the full year 2019, household savings amounted to SEK 248 billion, which is the highest level of savings ever for a full year. Since 1996, average household savings has been SEK 126 billion per year.

Households’ financial wealth, that is, financial assets minus liabilities, amounted to SEK 11 177 billion at the end of the fourth quarter of 2019, up by SEK 384 billion during the quarter. Households’ financial wealth is largely share-based and is affected by the development in the stock market. In the fourth quarter, the Affärsvärlden general index rose by 9 percent, which contributed to an increase in the value of financial assets.

Central government net financial debt decreased, local government net financial debt increased

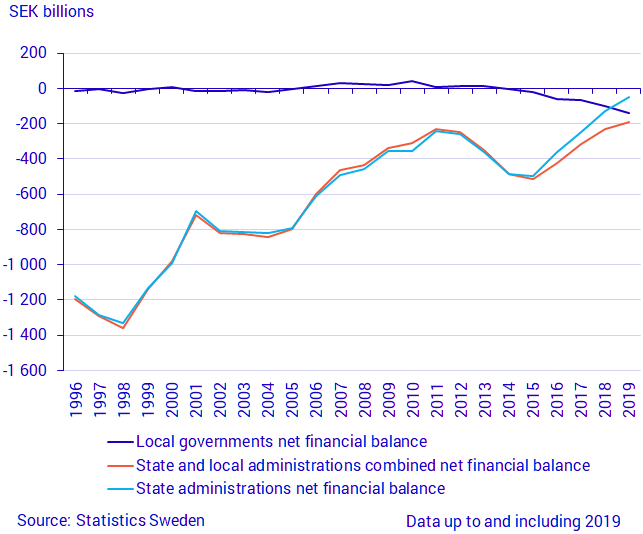

Central government debt amounted to SEK 1 983 billion at the end of the fourth quarter of 2019. Central government financial wealth, that is, financial assets minus liabilities, amounted to a net debt of SEK 49 billion at the end of the fourth quarter of 2019, which is the lowest level of net debt since the start of the time series in 1996. Local government net debt amounted to SEK 142 billion at the end of the quarter. Local government net debt has increased for some time and, after the third quarter of 2019, exceeded the central government net debt for the first time. Total central and local government net debt increased by SEK 191 billion in the fourth quarter of 2019, as the increase in the local government net debt was larger than the decrease in the central government net debt.

Non-financial corporations’ financing

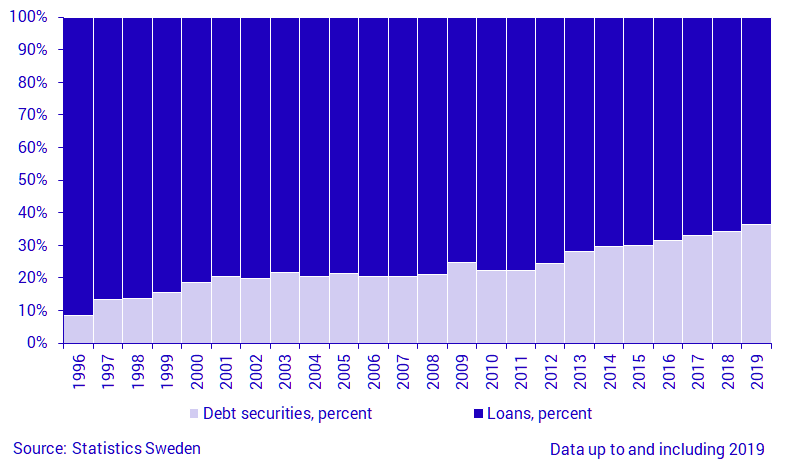

Non-financial corporations are mainly financed via loans from monetary financial institutions and by issuing debt securities. Total debt for these forms of financing amounted to SEK 3 756 billion at the end of 2019, up by SEK 272 billion from 2018.

In the full year 2019, non-financial institutions increased their financing via issued debt securities by SEK 167 billion, which is 50 percent more than for the full year 2018. New loans from monetary financial institutions amounted to SEK 90 billion in 2019, down 38 percent from 2018. Although borrowing mainly occurred in debt securities in 2019, loans from monetary financial institutions remained the largest form of financing, with a percentage of financing of more than 60 percent at the end of 2019.

Revisions

In connection with this publication, revisions were made for all quarters in 2018 and 2019. In addition, revisions of quarters in 2016-2017 were made concerning the rest of the world sector, the household sector and public administration. Furthermore, there were comprehensive revisions in the fourth quarter of 2019 with regard to the household sector, compared with the publication of the Savings Barometer. This mainly affected updated information on tax accrual that affects savings in the household sector.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they comprise of the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

More information: the National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thereby consistent with the values published in the Financial Accounts.

For more information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publication on 2020-06-17 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.