Financial accounts fourth quarter 2020

Central government debt increased in 2020

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2021-03-18 9.30

The market valued central government debt increased by more than SEK 200 billion in 2020 as a result of the emergency measures introduced so far by the central government during the COVID-19 pandemic. During the pandemic, household saving has increased more than in previous years, and financial saving remained high in the fourth quarter of 2020.

In 2020, the market valued central government debt increased by SEK 216 billion and amounted to SEK 2 217 billion at the end of the year. This increase was mainly due to increased borrowing to finance the support measures introduced so far by central government. In 2020, central government financial saving amounted to minus SEK 164 billion. This can be compared with positive financial saving of SEK 72 billion in 2019, when the central government debt decreased by over SEK 100 billion. In addition to increased borrowing, a strengthened Swedish krona in 2020 also contributed to a larger central government debt, as more than one-sixth of central government issued debt securities were denominated in foreign currency.

High level of household saving in 2020

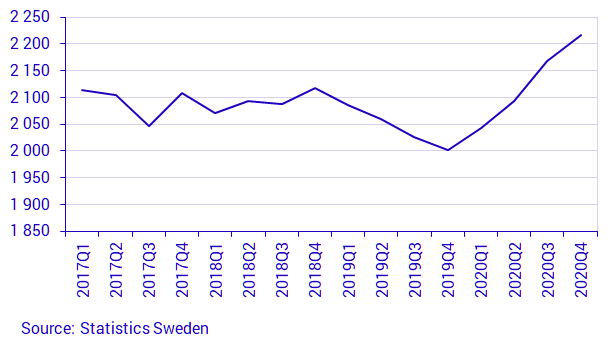

In the fourth quarter of 2020, households’ financial assets increased by SEK 120 billion, while liabilities increased by SEK 85 billion, which led to financial saving of SEK 35 billion. In 2020, household saving amounted to SEK 305 billion, which is the highest level of saving for a full year since the beginning of the time series in 1995.

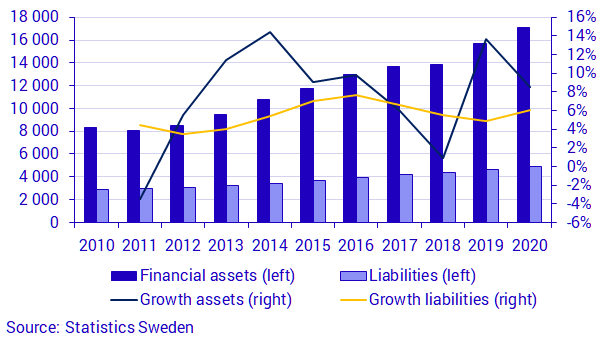

Despite the COVID-19 pandemic, households’ financial net wealth increased by SEK 1 061 billion in 2020 and total net wealth amounted to SEK 12 172 billion. Net wealth has more than doubled in the last ten years. Pension saving and tenant ownership rights were the two largest items among households’ financial assets.

In 2020, the main contribution to increased net wealth came from equity-related assets, as listed shares and households’ holdings in equity funds increased by 18 percent each. Households’ assets in pension saving and tenant ownership rights also increased during the year, by 7 percent and 8 percent respectively.

The value of households’ financial assets has increased every year since 2010, except in 2011. Taken over a ten-year period, on average, assets have increased more than liabilities. Households’ financial assets have increased by 8 percent per year on average, while liabilities have increased by 6 percent on average.

Changes in the Riksbank bond holdings

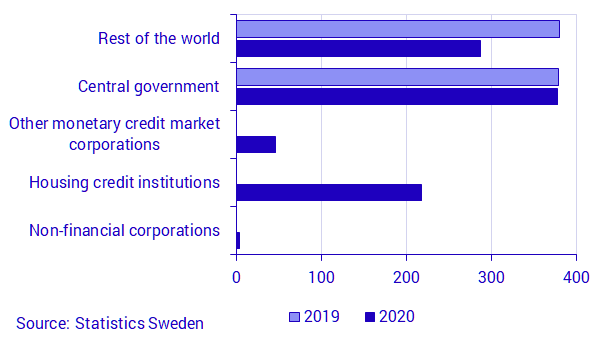

In the fourth quarter of 2020, the Riksbank continued to purchase bonds aimed at keeping interest rates in general at a low level and contributing to an efficient supply of credit. The Riksbank’s holdings in bonds amounted to SEK 931 billion at the end of 2020, which is SEK 173 billion more than in 2019.

During the 2020 COVID-19 pandemic, the Riksbank purchased both mortgage bonds and corporate bonds. In 2020, the Riksbank made net purchases of bonds issued by monetary financial institutions, largely mortgage bonds, of SEK 264 billion. Holdings of corporate bonds amounted to SEK 3 billion at the end of 2020. The Riksbank also continued to purchase government bonds, and holdings amounted to SEK 377 billion at the end of the year. Holdings of foreign bonds decreased by SEK 94 billion in 2020.

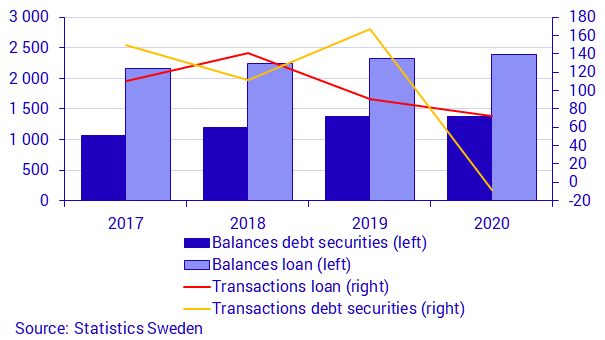

Non-financial corporations’ financing

Non-financial corporations’ financing via issued debt securities decreased as a result of the COVID-19 pandemic outbreak, but has once more become increasingly important as a form of financing in the past two quarters. In the fourth quarter of 2020, non-financial corporations made net emissions, that is, new emissions minus maturity, amounting to SEK 31 billion. In the full year 2020, net emissions were negative and amounted to minus SEK 8 billion. Loans in banks and other monetary financial institutions remain the most common form of financing for non-financial corporations and net borrowing was SEK 72 billion in 2020.

New emissions of listed shares was also a common form of financing for non-financial corporations in 2020. New emissions minus repurchase amounted to SEK 44 billion in the fourth quarter and SEK 88 billion in the full year 2020.

Revisions

In connection with the calculation of the fourth quarter 2020, annual and quarterly statistics were revised from the first quarter of 2017 up to and including the third quarter of 2020. Financial assets and liabilities for the rest of the world sector to Swedish sectors have been revised as new and more definitive data has been made available from the Balance of Payments. There were major revisions of Swedish investments in foreign funds and unlisted shares, as well as revisions of foreign investment in Swedish shares. Transactions in foreign funds have been revised for all sectors due to minor revisions of retained dividends. In public administration there have been several revisions from 2017 and onward. The major revisions have mainly addressed taxes and other accrual items in which quarterly distribution has been updated. Households’ loans in mortgage credit companies were introduced in the Financial Accounts for the first time in this publication. Data has been implemented as from the fourth quarter 2018 and onward. Mortgage credit companies are classified as other financial intermediaries and are included in the sector S125-127.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial saving and financial wealth in different economic sectors.

Financial saving, net lending/net borrowing, in the Financial Accounts is calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, the financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial Accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial Accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they constitute the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

Further information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from Financial Accounts and are thereby consistent with the values published in Financial Accounts.

For further information, see:

Next publishing will be

The next statistical news in this series is scheduled for publication on 2021-06-17 at 09.30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.