Financial accounts second quarter 2019

Households’ financial wealth continued to rise

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2019-09-24 9.30

Households recorded strong positive financial savings in the second quarter of 2019, and for the first time households’ net financial wealth exceeded SEK 10 000 billion.

In the second quarter of 2019, households’ net financial wealth, that is, financial assets minus liabilities, increased to SEK 10 227 billion. In total, net wealth increased by SEK 356 billion, distributed among increases in value of SEK 253 billion and financial savings of SEK 103 billion.

The SEK 103 billion in financial savings was the highest listing in a single quarter since 1996 when the time series was launched. The main contributor to these savings was net savings of SEK 60 billion in bank accounts.

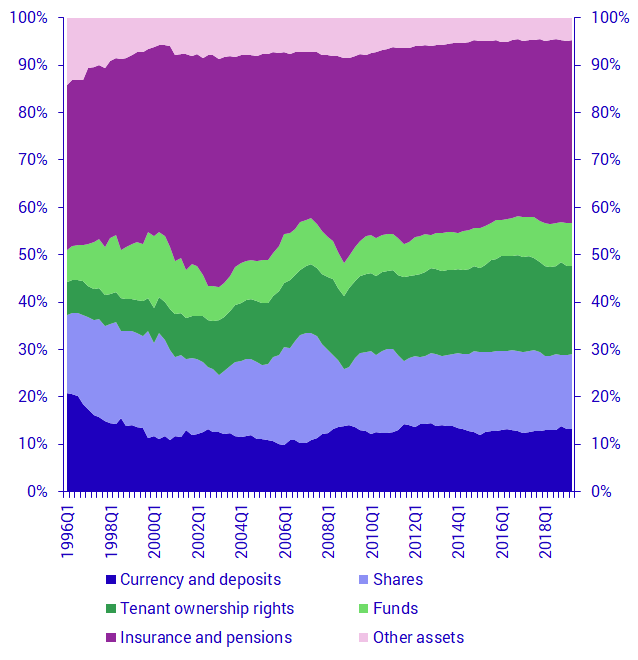

Households’ financial assets are largely equity-related and are therefore affected to a large extent by stock market development. According to the Affärsvärlden general index, the Stockholm Stock Exchange rose by 4.7 percent during the quarter, which was a strong contributing factor to the increased value in households’ financial assets.

Data up to 2019Q2. Source: Statistics Sweden

In the last ten years, the Affärsvärlden general index has increased by 119 percent. During the same period, households’ shares in different forms of savings has remained relatively constant. The fact that savings in bank accounts have remained relatively constant during this period can be explained by net savings in bank accounts exceeding net purchases of equity-related assets to the degree that it corresponds to the value increase of the same.

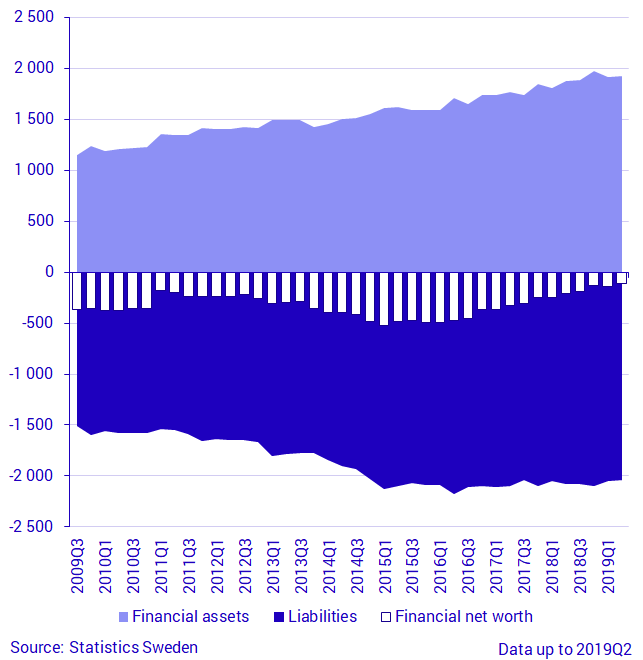

Central government debt declined

At the end of the second quarter 2019, the government debt amounted to SEK 2 038 billion, which was a decrease of SEK 16 billion compared with the previous quarter.

In the last three years, government debt has decreased by SEK 141 billion, despite the fact that a weakening of the Swedish krona affected the debt in the opposite direction. During the same period, central government financial assets have increased by SEK 220 billion and net financial wealth, that is, financial assets minus liabilities, has increased from SEK -473 billion to SEK -113 billion. In addition to financial assets, central government and other sectors also have non-financial assets that are not included in the Financial accounts, but are included in the National Wealth.

Non-financial corporations continued to finance themselves via debt securities

Non-financial corporations’ borrowing via issued debt securities and via loans in monetary financial institutions amounted to SEK 1 336 billion and SEK 2 391 billion respectively at the end of the second quarter of 2019. New financing via issues of debt securities amounted to SEK 82 billion during the quarter, which strengthens recent years’ development, in which this form of financing has become increasingly important. In the last three-year period, debt securities have increased from 30 percent to 36 percent as a share of borrowing via issued debt securities and loans in monetary financial institutions.

Revisions

In connection with the calculation of the second quarter 2019, yearly and quarterly statistics have been revised for the years 1996–2018. Some of the more comprehensive revisions implemented are described here and more information about the revisions is available via the link below. Households’ assets in foreign-registered funds have been revised from 2012 and forward and the Balance of payments is now the new source for these assets. Households’ tenant ownership rights have been revised as far back as 2003 with new statistics on the number of newly built tenant ownership rights. A calculation has been introduced for pension assets that households that have moved abroad have brought with them. The distribution between the financial assets of insurance corporations and of pension funds has been revised from 2009. The foreign sector has been revised from the first quarter 2017 with new information from the Balance of payments, as well as a new calculation of transactions in unlisted shares. Several major revisions of public administration have also been implemented as a result of a general overview.

For more information on the implemented revisions, see Revideringar i Finansräkenskaperna september 2019 (only available in Swedish).

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in savings and wealth for different economic sectors. The financial accounts’ financial savings, net lending/net borrowing, are calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing are measured as the difference between income and costs in the non-financial sector accounts, which, like the financial accounts, form part of the national accounts. However, financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. In the Financial accounts, the national debt is unconsolidated and includes all financial instruments at market value. For a calculation based on the convergence criteria, nominal value is reported and only some financial instruments are included.

More information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial accounts. Financial assets and liabilities are collected from the Financial accounts and are thereby consistent with the values published in the Financial accounts.

For further information:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publication on 2019-12-19 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.