Financial accounts second quarter 2021

Households’ loans rose

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2021-09-23 9.30

In the second quarter of 2021, households once more noted positive financial savings, while the growth rate of loans continued to rise. Non-financial corporations financed themselves both via bank loans and new issues, while the central government continued to note negative savings.

Households’ savings in financial assets amounted to SEK 248 billion in the second quarter of 2021, up by SEK 24 billion from the first quarter of 2021. The main contributions to this increase came from bank deposits and insurance savings. Households’ net increase in loans, that is, new loans minus amortisations, amounted to SEK 94 billion, which is the largest increase in a single quarter since the beginning of the time series. Households’ financial net savings amounted to SEK 155 billion.

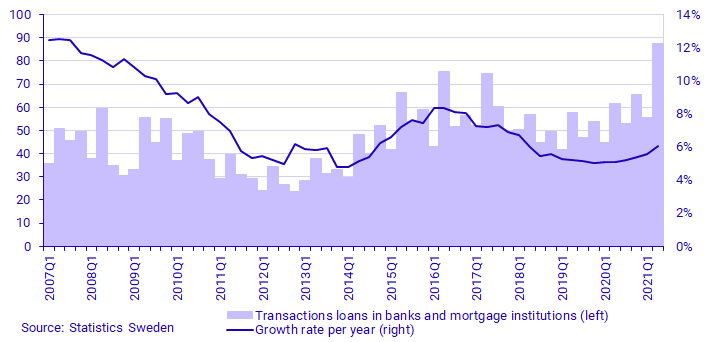

Households’ loans consist mainly of loans in banks and housing credit institutions. The loan stock has increased over time, but the annual growth rate has fluctuated. At the beginning of 2007, the annual growth rate was 12 percent, and fell subsequently to 5 percent at the beginning of 2014. After an increase between 2014 and mid-2016, when the first amortisation requirement was introduced, the growth rate slowed for some time, only to increase again in mid-2020. The most recent increase coincides with an offer of a grace period on amortisation.

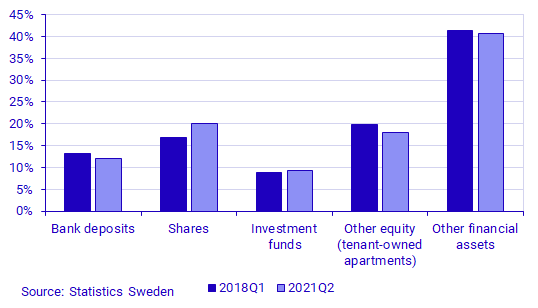

Since 2018, households’ financial assets have remained relatively stable across various types of assets. Bank deposits accounted for 13 percent on average, while funds and shares accounted for 9 percent and 18 percent, respectively. Owner-occupied dwellings accounted for 19 percent on average, while other assets such as insurance and other financial assets accounted for the remaining 41 percent. It is worth noting that these percentages have remained stable despite the major upturn on the stock exchange and low rates on deposits. The OMX Affärsvärlden general index increased by 62 percent since 2018. This means that savings in bank accounts, which have noted considerable lower yield than the stock market, increased almost exclusively due to deposits.

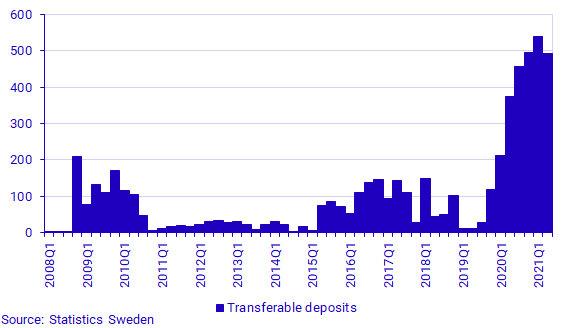

In the second quarter of 2021, households’ savings in bank accounts amounted to SEK 77 billion, which is SEK 48 billion more than in the first quarter of 2021 and SEK 3 billion more than in the second quarter of 2020.

Continued negative savings for the government

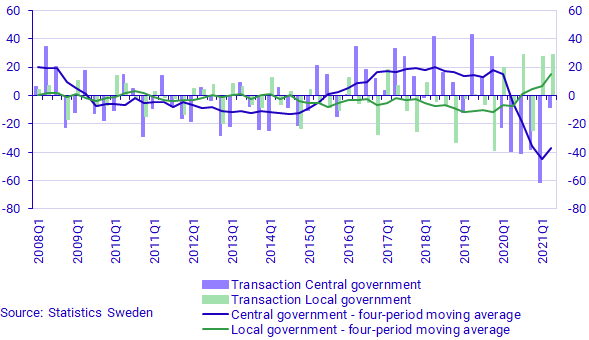

Central government savings in the second quarter of 2021 were negative, the same as in all quarters affected by the pandemic. Savings amounted to SEK -9 billion, which is SEK 52 billion more than in the previous quarter. Savings are normally high in the second quarter due to distribution of dividends. However, it is still worth noting that savings in the second quarter of 2021 were considerably higher than in the corresponding quarter of 2020, when savings amounted to SEK -40 billion.

In the aftermath of the 2008 financial crisis, central government savings were low, and have been generally negative for a number of years. Compared with the 2008 financial crisis, the packages of measures linked to the COVID-19 pandemic have had a much greater short-term impact on central government savings. It remains to be seen what impact the COVID-19 pandemic will have on public finance going forward.

During the COVID-19 pandemic, financial savings by municipalities and regions have been propped by central government support measures, and total savings since the beginning of 2020 amounts to SEK 75 billion. In the second quarter of 2021, savings were positive and amounted to SEK 29 billion.

Non-financial corporations financed broadly

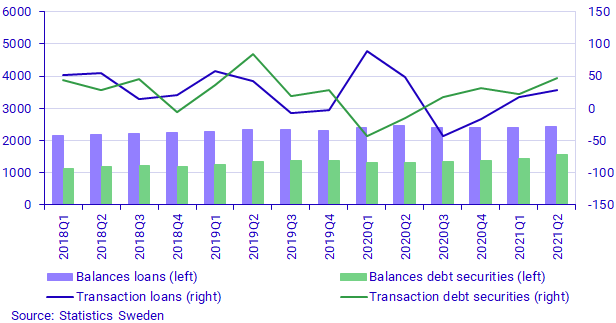

In the second quarter of 2021, non-financial corporations were financed by both loans in monetary financial institutions and debt securities issue. Net borrowing amounted to SEK 29 billion and net issue, that is, new issue minus maturity, amounted to SEK 48 billion. In the first six months of 2021, non-financial corporations’ liabilities with monetary financial institutions increased by SEK 45 billion and liabilities via net issue, that is, issue minus maturity, in debt securities increased by SEK 71 billion.

Banks’ high surplus liquidity dropped somewhat

During the COVID-19 pandemic, commercial banks have sharply increased deposits with the Riksbank. Between the first quarter of 2020 and the first quarter of 2021, the banks increased deposits with the Riksbank by SEK 84 billion per quarter on average. In the second quarter of 2021, banks’ deposits with the Riksbank decreased in relation to other quarters during the pandemic, but remained at a historically high level.

Revisions

In conjunction with the production of the second quarter 2021, yearly and quarterly statistics have been revised for the period 1996-2021Q1. Riksbank holdings in debt securities have been revised as from the first quarter of 2020 using data from the database on securities holdings (VINN). Furthermore, the rest of the world sector was revised as from the first quarter of 2019 with new data from the Balance of Payments. Several revisions have also been made concerning public administration. With regard to the central government sector, a review was carried out of bond repurchases (premiums and discounts) in the period 2001-2016. This review affects transactions and revaluations, but does not affect the balance in bonds. Other revisions mainly concern 2019 and onwards. In the municipal sector, revisions were carried out for 2019 and forward due to the introduction of new data sources for the 2020 yearly calculation. In the last publication, a subset of fund assets in the first quarter of 2021 was erroneously published as gross in the social security funds sector. This has now been amended to net. This amendment affects the items Other unpaid/prepaid income and expenses on the asset side, and short-term loans on the liability side. Both balance and transaction have been corrected, while the effect of savings and balances is null.

New data source introduced for securities statistics

In connection with the publication of the second quarter 2021, the Financial Accounts/National Accounts have begun a transition to new data sources and methods of compiling statistics on debt securities, shares and funds.

Data for the second quarter of 2021 has been collected largely from the database on securities holdings (VINN), instead of separate collections, as previously. This may lead to a break in the time series due to new counterparty classification and other differences in definition. Holdings previously classified as holdings in mortgage bonds, for example, can now be broken down by holdings in mortgage bonds and bank bonds. Breaks in the time series may also arise due to the fact that securities lending, erroneously reported in duplicate before, has now been reported correctly. Further information in the introduction of VINN is available under “More information” on the Financial Accounts product page.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, and about changes in financial savings and financial wealth in different economic sectors.

Financial savings, net lending/net borrowing, in the Financial Accounts are calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing is measured as the difference between income and costs in the non-financial sector accounts, which, like the Financial Accounts, form part of the National Accounts. However, the financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

In the Financial Accounts, the national debt calculation is different from the measure of national debt most often reported, which is calculated based on the convergence criteria, also known as the Maastricht debt. The Maastricht debt does not comprise all financial instruments; the instruments are reported at nominal value, and the central government debt is consolidated. In the Financial Accounts, the national debt is unconsolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain government foundations and some State-owned enterprises. Central government does not include units in the old-age pension system. Instead, they constitute the sector social security funds. Local government includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, some municipal foundations, and some local government-owned enterprises.

More information: the National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thereby consistent with the values published in the Financial Accounts.

For more information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news item in this series is scheduled for publication on 2021-12-16 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.