Savings Barometer, 3rd quarter 2022

Households reduced their new borrowings – lowest level in eight years

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2022-11-17 8.00

In the third quarter of 2022, households borrowed a net amount of SEK 33 billion, which was the lowest level of new borrowings in eight years. At the same time, households continued to save, and financial savings reached the highest level ever measured for a third quarter. Nonetheless, financial net wealth declined, mainly due to falling stock market prices and a sustained price decline for tenant-owned apartments.

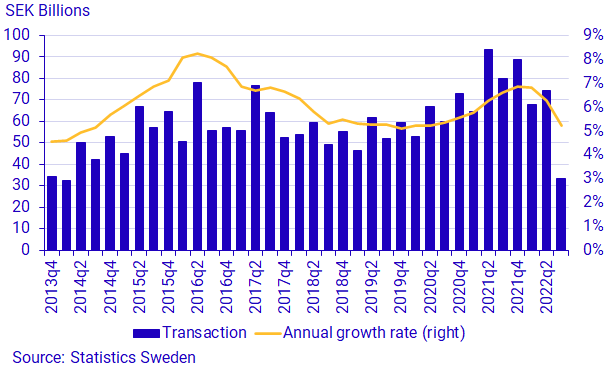

The growth rate in loans to households continued to decline in the third quarter of the year. The annual growth rate for loans was 5.2 percent, which is one percentage point lower than in the previous quarter. Households’ loans, which mainly consist of loans from banks and mortgage institutions, amounted to SEK 5 194 billion at the end of the quarter. Households’ net borrowings consist of new loans minus amortisation, and amounted to SEK 33 billion in the third quarter. A reason for the decrease is the rising interest rates that were made during the quarter.

“Households’ growth in loans has risen for a long time and especially during the covid-19 pandemic. What we are seeing now is a break in the trend, with new borrowings of households at the lowest level since the first quarter of 2014. This is probably a reaction to rising interest rates and the great uncertainty in the economy,” comments Nicolai Nystrand, Economist/Statistician at the Financial Accounts.

Record-high financial savings

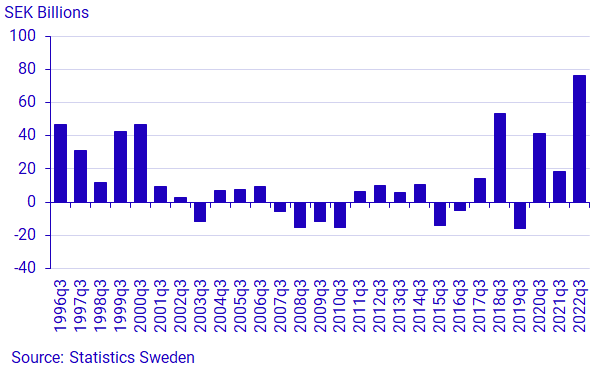

At the end of the third quarter of 2022, households’ new savings in financial assets amounted to SEK 106 billion. At the same time, debts rose by SEK 30 billion, which resulted in a financial savings of SEK 76 billion. This was a record-high level of financial savings for a third quarter. Savings have been high throughout all three quarters of 2022, and so far this year financial savings among households have reached a level of SEK 357 billion.

There is a seasonal variation in households’ financial savings, with savings usually lower in the third quarter compared with the first and second quarters. However, in the third quarter of 2022, households’ financial savings were at an elevated level for a third quarter, mainly because households had taken out loans to a lesser extent than in previous quarters.

Market value of tenant-owned apartments continued to fall

In the third quarter, interest rates rose and the market value of tenant-owned apartments fell by 4.3 percent. Households’ assets in tenant-owned apartments at the end of the third quarter amounted to SEK 3 148 billion, which was a decrease of SEK 134 billion compared with the previous quarter. This was the second consecutive quarter in which the market value of tenant-owned apartments declined. Households’ net purchases of new tenant-owned apartments, consisting of newbuilds and conversions, were in line with the same quarter last year, amounting to SEK 8 billion.

Net sales of funds and net purchases of shares among households

In the third quarter of 2022, the stock market declined by 3.7 percent according to Affärsvärlden’s general index. Over the same period, households purchased shares to a net amount of SEK 16 billion, while at the same time selling funds to a net amount of SEK 6 billion. Households have sold funds net throughout the whole of 2022, and in the third quarter it was other funds, consisting of hedge funds and fund-of-funds, that households sold the most, to a value of SEK 12 billion.

In the first two quarters of 2022, households had high net savings in bank accounts, and in the third quarter households’ deposits continued to rise but not to as great an extent as in previous quarters of the year.

Financial net wealth continued to decline

Since the end of 2019, just before the outbreak of the covid-19 pandemic, until the end of 2021, households’ net wealth rose by around 30 percent. From these high levels, net wealth has declined in each quarter of 2022, reaching SEK 12 660 billion at the end of the third quarter. Since the end of 2021, households’ net wealth has decreased by 16 percent. The main reasons for the decrease in the quarter is the decline on the Stockholm stock exchange and the sustained drop in market prices of tenant-owned apartments.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. The statistics are reported in current prices and do not take account of inflation.

Households’ ownership of tenant-owned apartments is a financial asset and is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included however, since they constitute real assets. Information on households’ total assets in dwellings is available in the publication National Wealth.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the third quarter of 2022, the time series is updated with the revisions introduced into the Financial Accounts’ publication on 22 of September.

More detailed descriptions of major revisions are provided in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

For more information, see:

Nationalförmögenheten och nationella balansräkningar (pdf)

Statistical database;

Next publishing will be

2023-02-16 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.