Securities issues, December 2024

Decreased borrowing in debt securities

Statistical news from Statistics Sweden 2025-01-17 8.00

At the end of December, total liabilities in debt securities amounted to SEK 9 315 billion, down by SEK 280 billion from November. This decrease is mainly due to net redemptions by the Sveriges Riksbank and monetary financial institutions.

From reference month October 2024, the statistics will be replaced with new tables available via the Statistical Database (SSD). Securities issues is now presented with new breakdowns and information on green securities (from January 2022).

Developments in December 2024 in brief

Decreased liabilities in money market instruments

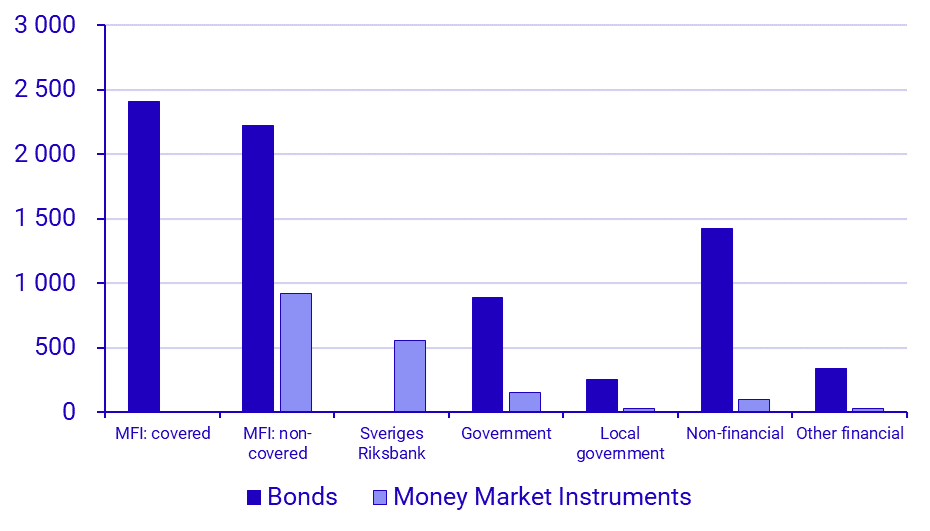

- At the end of December, total liabilities in debt securities amounted to SEK 9 315 billion, of which bonds accounted for 81 percent and money market instruments accounted for 19 percent.

- During the month, liabilities decreased in both bonds and money market instrumenst by SEK 62 billion and SEK 219 billion respectively.

- The liabilities denominated in Swedish Crowns decreased by a total of SEK 185 billion and liabilities denominated in foreign currencies by SEK 96 billion. This is largely due to net redemptions.

- The annual growth rate for total debt securities liabilities was 5 percent in December, up by 1.3 percentage points compared to November.

Decreased borrowing by Sveriges Riksbank

- In December, Sveriges Riksbank and monetary financial institutions accounted for the largest decrease in debt securities, and decreased their liabilities by SEK 128 billion and 215 billion respectively. Non financial corporations also decreased their liabilities by SEK 4 billion. The decrease is mainly an effect of net redemptions.

- The Government (through Swedish National Debt Office), on the other hand, increased their liabilities in debt securities during the month by SEK 66 billion.

Maturity structure

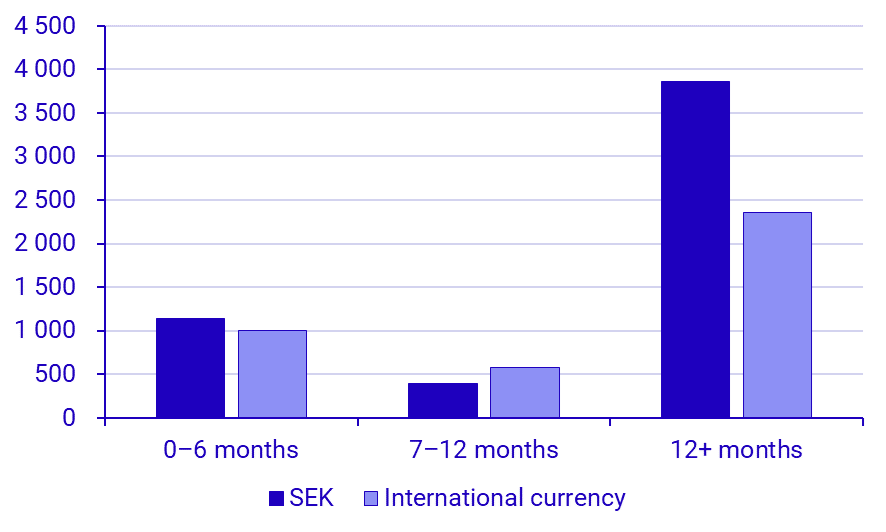

- Debt securities valued at SEK 1 582 billion will reach maturity within six months, excluding certificates issued by Sveriges Riksbank. 63 percent of these are denominated in foreign currency.

- Debt securities from monetary financial institutions accounted for 59 percent of the total maturity value within six months (excluding certificates issued by Sveriges Riksbank), of which the majority is issued in foreign currency.

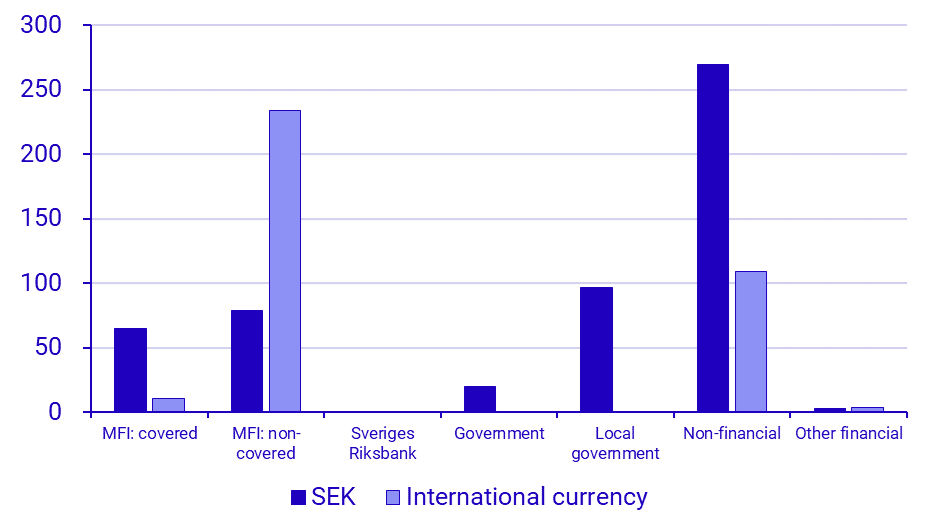

Green debt securities

- Green debt securities amounted to SEK 892 billion in December, up by SEK 5 billion from November.

- Monetary financial institutions accounted for the largest increase in green debt securities during the month, with an increase of SEK 3 billion, mainly denominated in Swedish Crowns.

- Monetary financial institutions are the largest issuer of green debt securites, in total SEK 390 billion. However, local government issue the largest share of green debt securities in relation to their total outstanding amount (35 percent).

Definitions and explanations

Contents of this publication

Statistics Sweden’s monthly publication on Securities issues covers total outstanding volume and maturity structure for debt securities issued by Swedish issuers. It describes the development and conditions of Swedish enterprises’ debt securities borrowing.

Revisions

Securities issues are compiled monthly. Revisions usually occur, mostly for the previous month but sometimes for older periods as well.

Next publishing will be

2025-02-18 at 8:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.