Shareholder statistics, June 2021

Share wealth rose sharply

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2021-09-02 9.30

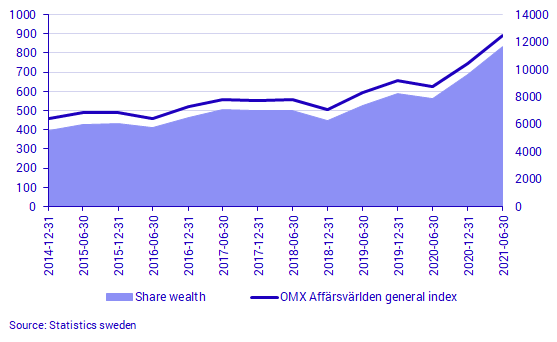

At the end of June 2021, share wealth in shares listed on Swedish marketplaces amounted to SEK 11 650 billion, up by SEK 2 031 billion. The foreign owners sector remained the largest owner sector and households’ share wealth amounted to SEK 1 445 billion. The proportion of shareholders in the population increased further during the first half of 2021.

Share wealth, that is, the sum of all shares listed on Swedish marketplaces, rose in the first half of 2021 and amounted to SEK 11 650 billion. This is an increase of SEK 2 031 billion, equivalent to 21 percent. The increase is not only due to share development - there was a record number of new listings and the OMX Affärsvärlden general index rose by 20 percent.

There were 969 listed companies, up by 78 during the first six months of 2021, and the largest increase in a single six-month period since the start of the time series.

Foreign owners remain the largest owner sector

Since the end of June 2020, changes in the ownership structure on Swedish marketplaces have been minor. The non-financial corporations sector noted the largest increase in holdings as a percentage of share wealth. Holdings in this sector increased by 0.9 percentage points over a year and amounted to 15 percent at the end of June 2021. The investment funds, households, and foreign owners sectors increased shareholdings by 0.2 percentage points in the same period.

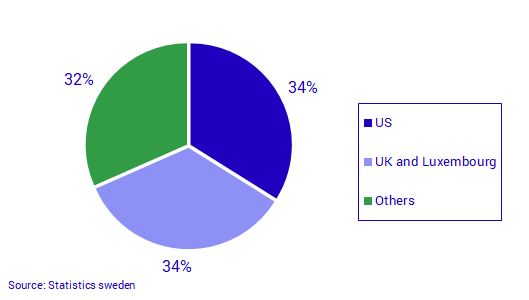

The foreign owners sector remained the largest owner sector and holdings accounted for 40 percent of the market value on Swedish marketplaces, followed by non-financial corporations and households. At the end of June 2021, foreign owners’ share wealth amounted to SEK 4 644 billion, which is SEK 810 billion more than at the end of 2020. The United States was the largest owner country in this sector, and accounted for just over one-third of foreign holdings, equivalent to almost one in seven Swedish kronor of share wealth on Swedish marketplaces. The United States has increased foreign share holdings by 3.6 percentage points since the end of 2020. The United Kingdom and Luxembourg accounted for 24 percent and 11 percent respectively, which combined corresponds to one-third of foreign holdings.

Number of shareholders with high incomes continues to grow

Households’ share wealth increased by SEK 259 billion in the first six months of 2021 and amounted to SEK 1 445 billion. Holdings accounted for one-eighth of the market value of listed shares on Swedish marketplaces.

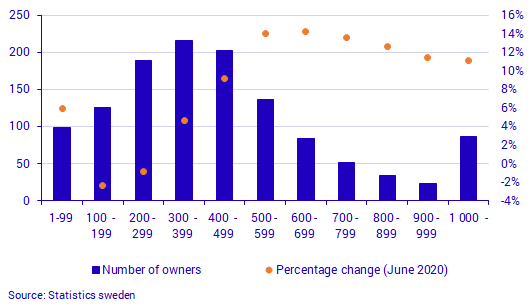

Since the end of June 2020, the number of shareholders has increased by 76 000, which is an increase of 6 percent. The largest increase in the proportion of shareholders was noted in groups with an annual income of at least SEK 500 000. In these groups, the proportion increased by between 11 and 14 percent during the period. The number of shareholders has increased in most income groups since June 2020, except in groups with an annual income between SEK 100 000 and SEK 300 000, where the number of shareholders has decreased.

Major differences between men and women in portfolio value

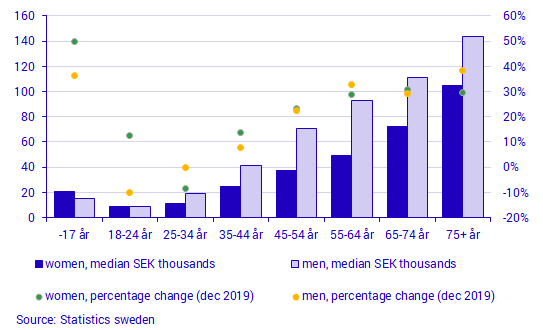

Swedish households’ median portfolio value, that is, the mean portfolio value by volume, varies by sex and age. At the end of June 2021, share wealth was greater among men than among women, based on the median portfolio value in all age groups, except the youngest age group, in which the median portfolio value was SEK 6 000 higher for women than for men. In the age group 18-24 years, there was no difference between the sexes in median portfolio value. The largest difference between the sexes in median portfolio value was noted in the age group 55-64 years, in which the median portfolio value was SEK 44 000 higher for men than for women. The largest median portfolio value was noted among men aged 75 years and older, who had a median portfolio value of SEK 144 000 at the end of June 2021.

Since the end of 2019, progress of portfolio value has varied based on sex and age. The median portfolio value increased the most among women up to 17 years; the median portfolio value has increased by 50 percent since the end of 2019. During the same period, the median portfolio for men aged 75 years and older increased by 38 percent, which was the second highest increase. The median portfolio fell among men aged 18-24 years, and among women aged 25-34 years.

These statistics do not include data on shareholders’ holdings via Swedish nominees if holdings are less than 501 shares in a listed enterprise. For more information, see Definitions and explanations.

Definitions and explanations

Information on the final owner is not available concerning ownership in security accounts via Swedish nominees if holdings are less than 501 shares in an enterprise, which means that these holdings are not included in a breakdown of households’ income and age. Information on foreign nominees’ final owners is not available, as these are not included in the public shareholders’ register. At the end of June 2021, households’ ownership in shares registered in security accounts amounted to 14 percent of total assets in shares.

Swedish marketplaces refer to OMX Stockholm, Spotlight Stock Market, NGM, and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies listed on the marketplaces mentioned above are included in the statistics from 2000 onwards.

Next publishing will be

Next publication date 2022-03-03

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.