Shareholder statistics second half of 2023

Strong stock market led to increased share wealth

Statistical news from Statistics Sweden 2024-02-29 8.00

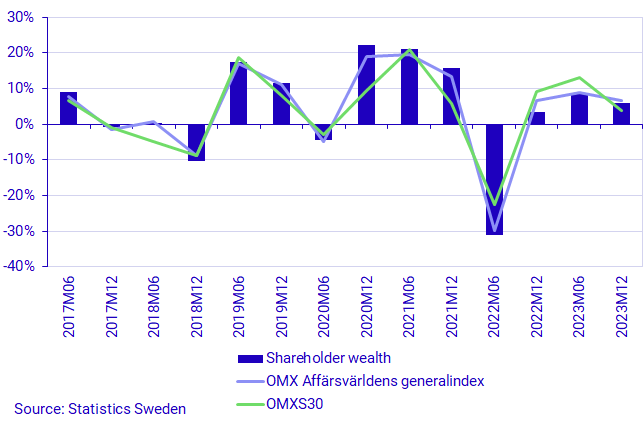

A strong stock market in 2023 increased the shareholder wealth by 15 percent compared to December 2022. Despite this, shareholder wealth is not back at the peak level from the end of 2021. Since then, shareholder wealth has fallen by 18 percent.

Development during the second half of 2023 in brief

- Shareholder wealth increased during the second half of 2023 and amounted to SEK 11,040 billion at the end of December.

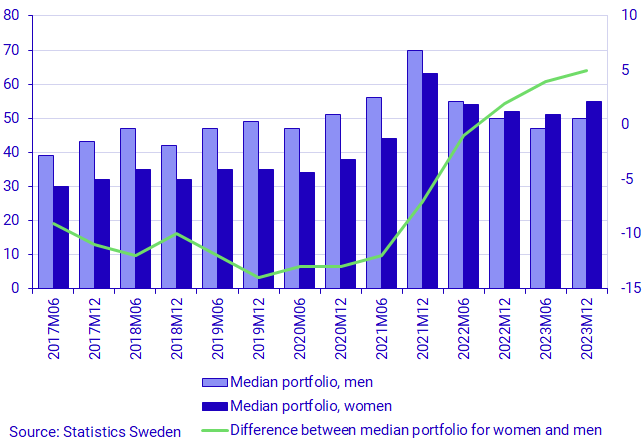

- Women's median portfolio remains larger than men's and the difference has increased by SEK 1,000 during the second half of 2023.

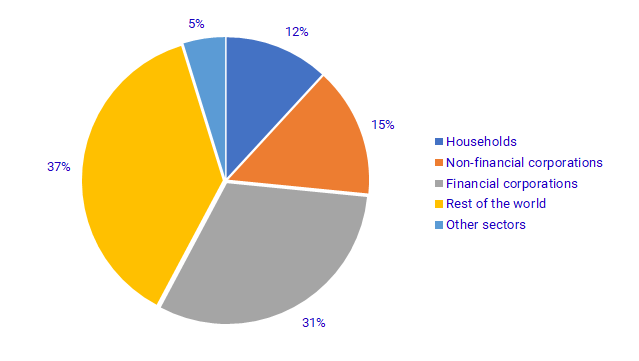

- Foreign ownership continued to be the largest ownership sector, followed by financial corporations.

During the second half of 2023, the market value of Swedish shares listed on Swedish marketplaces increased by SEK 607 billion, which was an increase of 6 percent compared with June. The OMX Affärsvärlden General Index rose by 7 percent, while the OMX Stockholm 30 index, which refers to the 30 most traded and liquid shares in Sweden, rose by 4 percent.

Women median portfolio still worth more than men's

At the end of 2022, for the first time since the start of the time series, the median portfolio for women was higher than that of men. The difference between the women and men median portfolio was then SEK 2,000. In 2023, this difference has increased to SEK 5,000. At the end of December, women median portfolio was worth SEK 55,000, while men's was worth SEK 50,000.

There is a wide spread among women and men individual equity portfolios. The average value is considerably larger than the median because there are relatively few individuals with large equity portfolios who drive up the average. At the end of December, the 5 percent of men och women with the largest holdings owned about 82 percent of the wealth in shares. Studying the median portfolio of men and women may be a more reliable measure from an overall perspective because the median is not affected by extremevalues in the same way as the average. However, when interpreting median portfolios, it should be considered that the median can also be affected by the distribution in individuals’ equity portfolios. For example, the median can be shifted downwards due to the addition of relatively more individuals with relatively smaller portfolios.

Foreign ownership decreased in 2023

The foreign sector continued to be the largest owner sector, with share wealth amounted to a value of SEK 4,133 billion at the end of 2023. This represents 37 percent of the total stock market value, which was a decrease of 1 percentage point compared to December 2022. The second largest owner sector was financial corporations with an ownership of 31 percent, which corresponded to SEK 3,446 billion.

Definitions and explanations

Information on the final owner is missing for nominee-registered ownership through Swedish nominees if the holding is less than 501 shares in a company. Because of this, these holdings are not included when household shareholdings are broken down by income and age. To address this, the difference between the number of issued shares and the number of securities with a known final-owner is distributed between the household sector and non-profit institutions serving households. At the end of June 2023, the allocated share in the household sector amounted to 13 percent of the total market value.

Information on foreign managers end customers is not available, as these are not included in the public registers of shareholders.

Swedish marketplaces refer to OMX Stockholm, Spotlight Stock Market, NGM and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies listed on the aforementioned marketplaces are included in the statistics from the year 2000 and onwards.

Next publishing will be

2024-08-29, 08:00.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.