Financial Accounts fourth quarter 2024

High savings for households in 2024

Statistical news from Statistics Sweden 2025-03-20 8.00

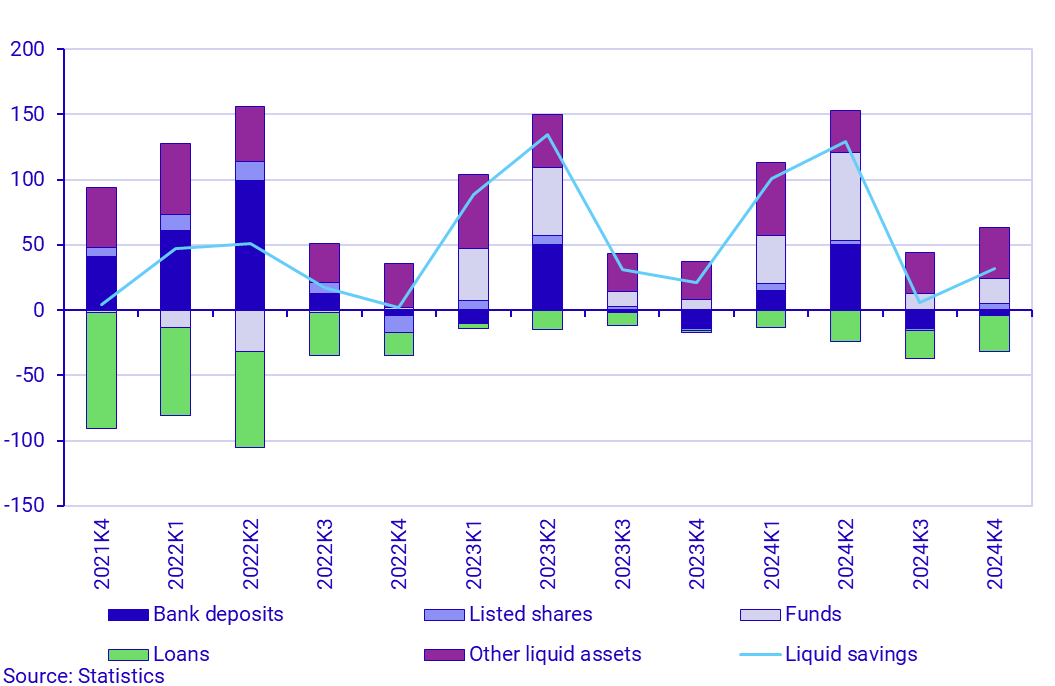

For the year 2024, liquid savings for the households amounted to SEK 268 billion, which in the time series is only surpassed by annual savings for 2023.

"We observed sustained high levels of savings for households in the fourth quarter, which means that liquid savings for the full year 2024, as well as for 2023, were very high from a historical perspective. It is noteworthy however, that the low level of new loans for households is the main reason for the high level of liquid savings in these years," says Emil Hermansson, economist at the Financial Accounts.

Households' liquid savings, i.e., their net transactions in financial liquid assets minus new loans, amounted to SEK 32 billion in the fourth quarter of 2024. This is an increase in liquid savings of SEK 26 billion compared with the previous quarter and SEK 11 billion compared with the corresponding quarter in 2023. Households' net purchases of investment funds amounted to SEK 19 billion in the fourth quarter of 2024. In the fourth quarter, households had net withdrawals from bank accounts of SEK 4 billion. Households' net loans during the quarter, i.e., new loans minus amortisation, amounted to SEK 28 billion, which is an increase of SEK 6 billion compared with the previous quarter and SEK 27 billion compared with the corresponding quarter in 2023.

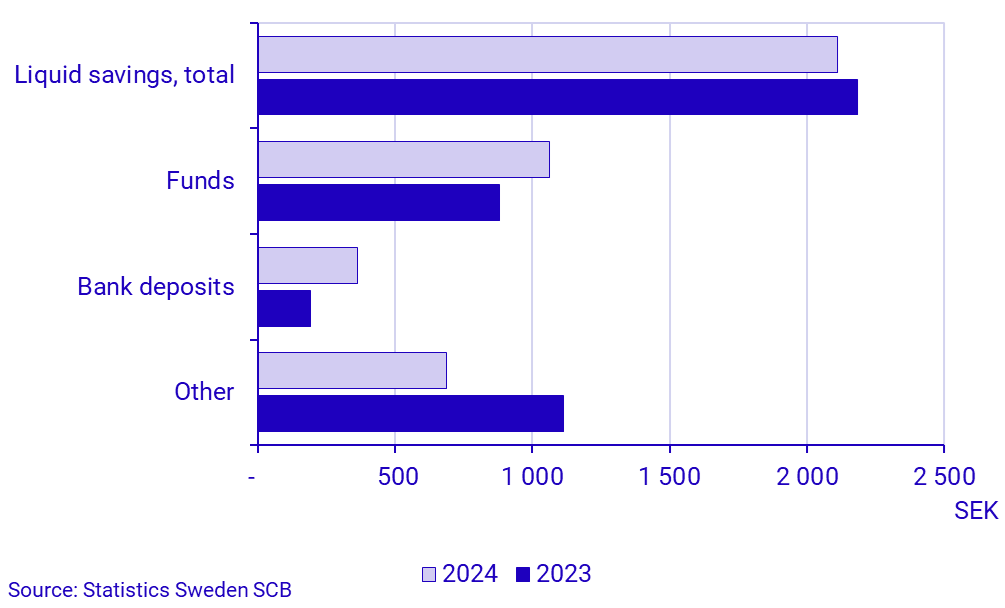

Swedes' monthly savings in funds amounted to just over SEK 1000 per person

The average Swede's liquid savings were slightly lower in 2024 compared to 2023. In 2024, the average savings were SEK 2113 per person per month. The corresponding figure for 2023 was SEK 2185.

On the other hand, several forms of savings increased among households in 2024 compared to the previous year. For the full year 2024, households saved SEK 138 billion in investment funds, which is an increase of SEK 27 billion compared to 2023. This gives the average Swede a saving of just over SEK 1000 per month in investment funds in 2024. The corresponding figure for 2023 was just over SEK 800.

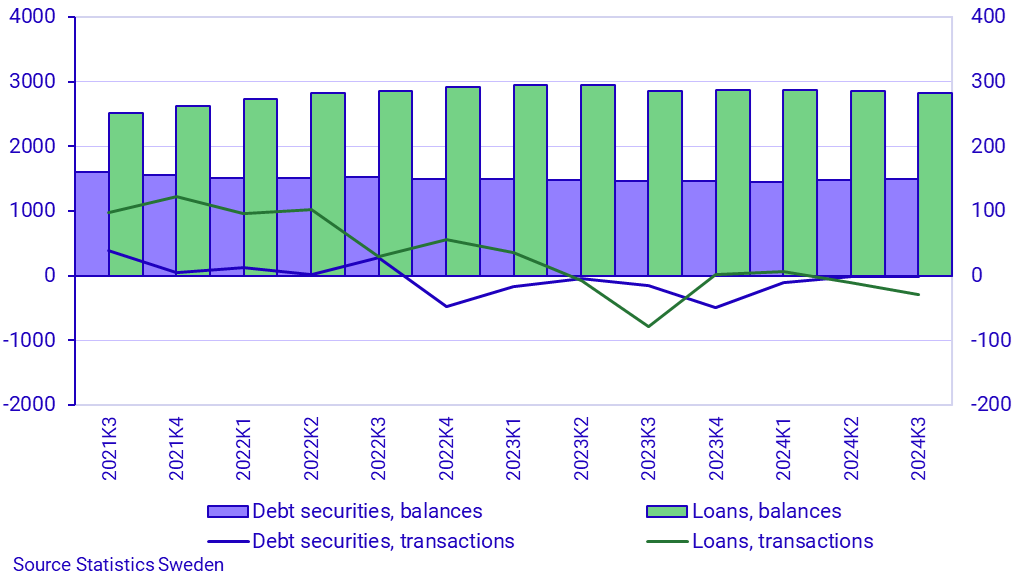

Financing of non-financial corporations

In the fourth quarter of 2024, the value of non-financial corporations' financing through loans, i.e., new loans minus amortisation from monetary financial institutions, was SEK -29 billion. This is a decrease of SEK 19 billion compared with the previous quarter and an increase of SEK 50 billion from the corresponding quarter last year.

Financing through interest-bearing securities, i.e., through new issues minus maturities and repurchases, amounted to SEK -1 billion. This is no difference compared with the previous quarter, but SEK 14 billion higher than the corresponding quarter last year.

Total loans from MFIs at the end of the quarter amounted to SEK 2 828 billion. The value of issued debt securities amounted to SEK 1 488 billion.

Revisions

In the publication of the Financial Accounts for the fourth quarter of 2024, revisions have been made back to 2020 in order to improve the statistics where new data have become available. The revisions affect both the time series for years and quarters.

The foreign sector has been revised back to 2021 with new data from the Balance of Payments.

Definitions and explanations

In the statistical news, reference is made to the liquid financial savings of households. It is calculated as the difference between transactions in financial assets and liabilities excluding accruals (tax accruals, occupational pensions and other technical provisions). For more information, see the Financial Accounts Quality Declaration, section 1.2.2.

The aim of financial accounts is to provide information on financial assets and liabilities as well as changes in financial savings and financial wealth for different sectors of society. The statistics are presented in current prices and do not take inflation into account.

The financial savings in financial accounts is calculated as the difference between transactions in financial assets and liabilities. In the Real Sector Accounts, which, like the Financial Accounts, are part of the National Accounts, financial savings are calculated as the difference between income and expenses. However, financial accounts and real sector accounts are based on different sources, which gives rise to differences between these two products.

In the Financial Accounts, the government debt is calculated differently from the government debt metric that is most frequently reported and which is calculated according to the convergence criteria – the ‘Maastricht debt’. The definition of the Maastricht debt does not include all financial instruments, the instruments are presented in nominal value and the liabilities for government administration are consolidated. The government debt in the Financial Accounts is unconsolidated and includes all financial instruments at market value.

In addition to the government agencies, the government administration sector also includes certain state foundations and state-owned companies. Government administration does not include entities within the retirement pension system. Instead, they make up the social security funds sector. Municipal administration includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations and certain municipal foundations and certain municipally or regionally owned companies.

More information: National wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For further information, see:

Next publishing will be

The next statistical news will be published on 2025-06-19 at 08:00.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.