Savings Barometer, 1st quarter 2022

High level of household savings despite selling off funds

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2022-05-19 8.00

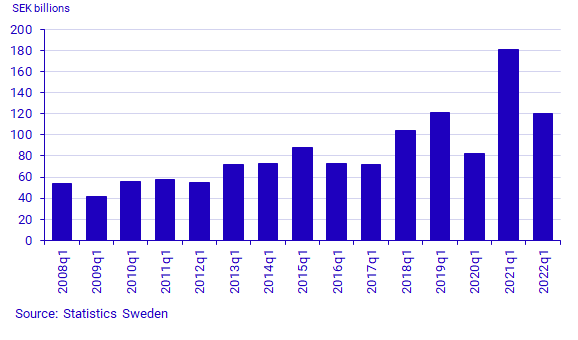

Households’ financial savings and net wealth were coined by stock market unease in the first quarter of the year. Financial savings amounted to SEK 120 billion in the first quarter, which was in line with the average for the first quarters of the past five years. During the quarter, households sold off funds and the annual growth rate in loans was unchanged.

Households’ new savings in financial assets were SEK 184 billion in the first quarter of 2022, while at the same time debts rose by SEK 63 billion, generating financial savings of SEK 120 billion. Households’ financial savings in the quarter largely consisted of savings in bank accounts, in occupational pensions and net tax accruals. Out of the total increase in debt, it was primarily loans – that is, new loans minus amortisation – that rose. In the past five years, households' financial savings for a first quarter have generally been at a higher level than in prior years. There is a seasonal variation in households’ financial savings, with savings having usually been higher in the first two quarters of the year.

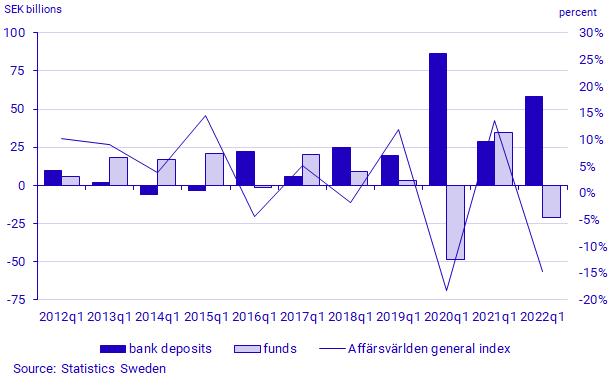

Net sale of funds by households

Fund units amounting to SEK 21 billion were sold net by households in the first quarter of 2022. The largest net sales consisted mainly of withdrawals from equity funds and other funds, at SEK 13 billion and

SEK 9 billion, respectively. The last time fund units were sold net by households was in the first quarter of 2020.

During the quarter, the Stockholm Stock Exchange declined by 14.7 percent according to the OMX Affärsvärlden general index. At the same time as the stock exchange performed negatively in the quarter, households bought listed shares net for SEK 13 billion. Unlisted shares also showed positive net savings of SEK 10 billion.

High level of savings in bank accounts

In the first quarter, households’ savings in bank accounts amounted to SEK 58 billion, which is a high level of saving for a first quarter. Households have had higher net deposits into bank accounts in a first quarter only one other occasion, which was the first quarter of 2020. In both of these quarters, households sold off a large share of funds.

In the past six years, households have had positive savings in bank accounts, with considerably higher levels since the start of the covid-19 pandemic.

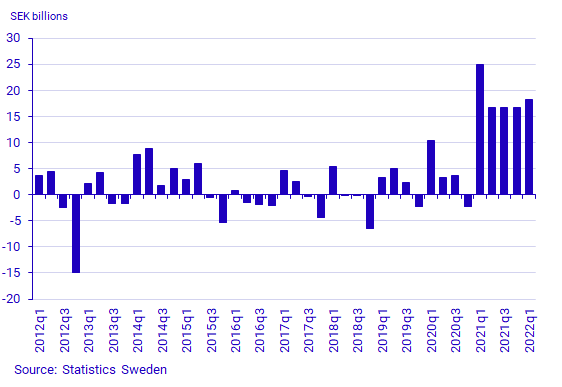

Sustained high level of private insurance savings

In the first quarter of 2022, private insurance savings were lower than in the same period of the previous year, albeit at a sustained high level. In the quarter, households saved SEK 18 billion net in private insurance savings. Private insurance savings have reached new highs since the transfer fees on individual insurance savings were reduced in 2021.

Unchanged growth rate in loans

In the first quarter of 2022, the annual growth rate in loans was 6.8 percent, which was an unchanged growth rate compared with the previous quarter. Prior to that, the annual growth rate in loans had risen each quarter since the first quarter of 2020. Households’ net borrowing amounted to SEK 71 billion in the first quarter of 2022 which is the highest net borrowing for a first quarter since the beginning of the time series.

Decline in financial net wealth

At the end of the first quarter of 2022, financial net wealth amounted to SEK 14 784 billion, which was SEK 724 billion lower than in the previous quarter. This was the first time in two years that households’ financial net wealth contracted. The main reason for the decline in value of financial net wealth was the stock market contraction in the quarter, as a large share of households' financial assets are equity-linked. It was primarily directly owned shares and funds as well as premium pensions, that caused the decline in value. On the other hand, households' assets in tenant-owned dwellings saw positive value growth of SEK 132 billion in the first quarter of the year. At the end of the quarter, assets in tenant-owned dwellings amounted to SEK 3 828 billion.

Definitions and explanations

Financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. The statistics are reported in current prices and do not take account of inflation.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, where there is more time for calculations and reconciliation with other sectors, and where revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the first quarter of 2022, the time series is updated as of the first quarter of 2018 with the revisions introduced in the Financial Accounts' publication on 17 March.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

For more information, see:

Nationalförmögenheten och nationella balansräkningar (pdf)

Statistical database;

Next publishing will be

2022-08-25 at 08:00.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.