Business cycle clock

Last updated: 2025-08-18

Recession or boom? Statistics Sweden’s business cycle clock shows the state and direction of the Swedish economy.

This page describes Statistics Sweden's business cycle clock and how to use it.

You can find the business cycle clock here.

On this page

- Brief information about the method

- The four business cycle phases

- The indicators of the business cycle clock

- How to interpret the business cycle clock

- More information

The purpose of the business cycle clock is to provide a clear way of showing how the business cycle changes over time. The clock consists of 14 economic indicators that are combined into a system. The system makes it possible to analyse the development of individual indicators by relating them to others. At the same time, it provides an overview of the state of the economy as a whole. The latter is particularly important. The movement of individual indicators should be interpreted with caution. The key factor of the business cycle clock is how the indicators move as a whole.

Do you want to see for yourself how the different indicators are moving? Then use the playback function of the clock.

Brief information about the method

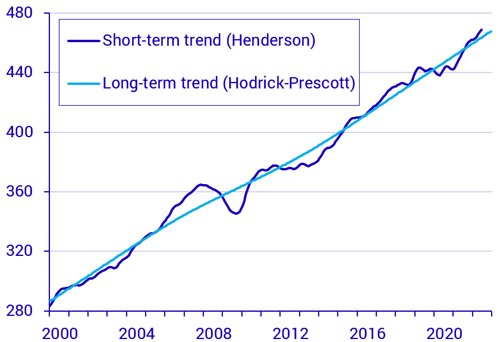

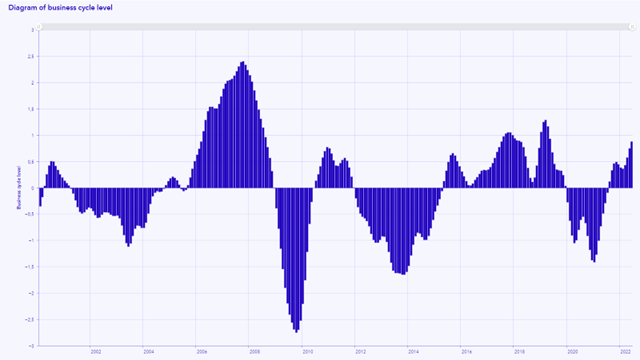

The business cycle situation is calculated for each indicator by estimating the deviation of the short-term trend from the long-term trend.

Example: GDP indicator monthly

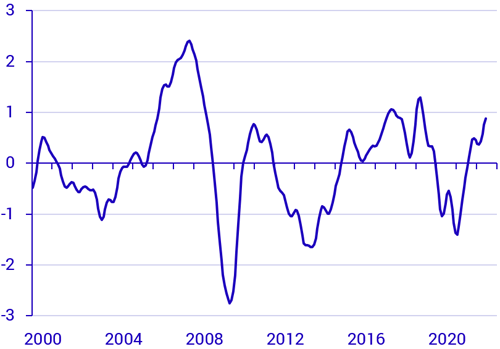

The deviation between the short-term and the long-term trend is then standardised with mean = 0. Positive values mean that the economy is stronger than normal, and negative values mean that it is weaker.

Example: GDP indicator monthly

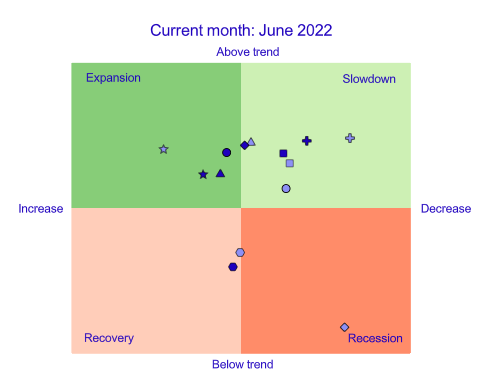

Another way of presenting the cyclical trend of the indicators is to mark them in a coordinate system with four quadrants. See the example below showing June 2022.

The vertical axis of the coordinate system is the deviation from the long-term trend, while the value on the horizontal axis is the change from the previous period (month or quarter). The diagram is referred to as a business cycle clock because the indicators (theoretically) move one revolution of the clock during a business cycle. In order for the indicators to move clockwise, the scale is reversed on the horizontal axis. This means positive values in the two left quadrants and negative values in the two right quadrants.

The movement of the indicators can be likened to a real clock where 12 o’clock corresponds to the peak of the boom and 6 o’clock corresponds to the trough of the recession.

Statistics Sweden’s business cycle clock, example shows June 2022

The four business cycle phases

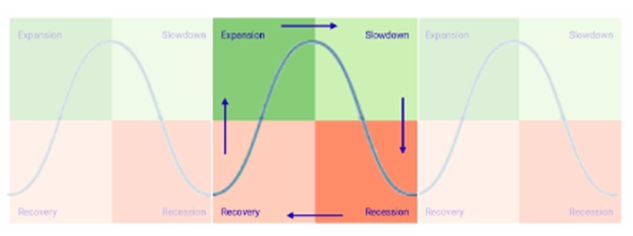

The indicators move one revolution of the clock during a business cycle, passing through four business cycle phases. It usually takes between three and eight years to pass through all of the phases. The business cycle clock starts again when the next business cycle begins.

Theoretical business cycle

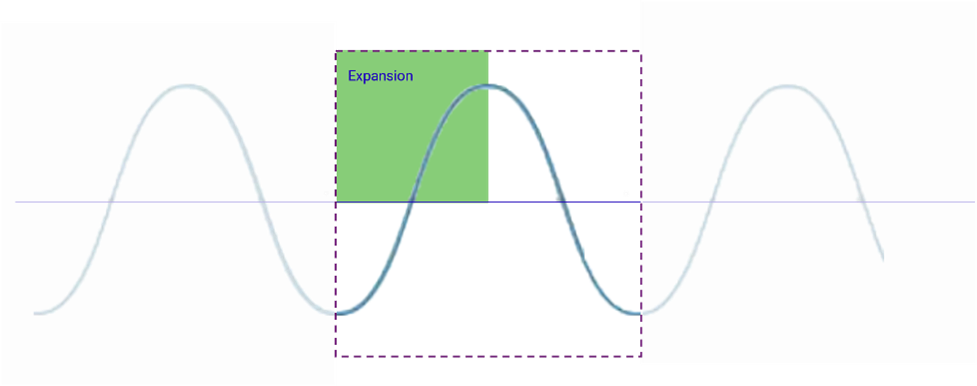

Expansion – the indicator is above the long-term trend and has an upward trend.

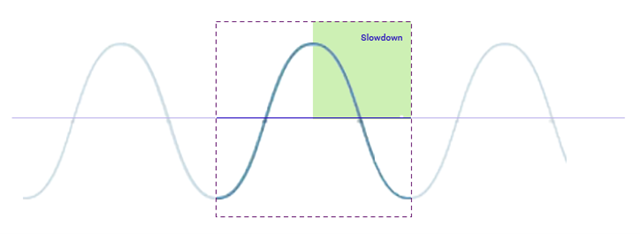

Slowdown – the indicator is above the long-term trend and has a downward trend.

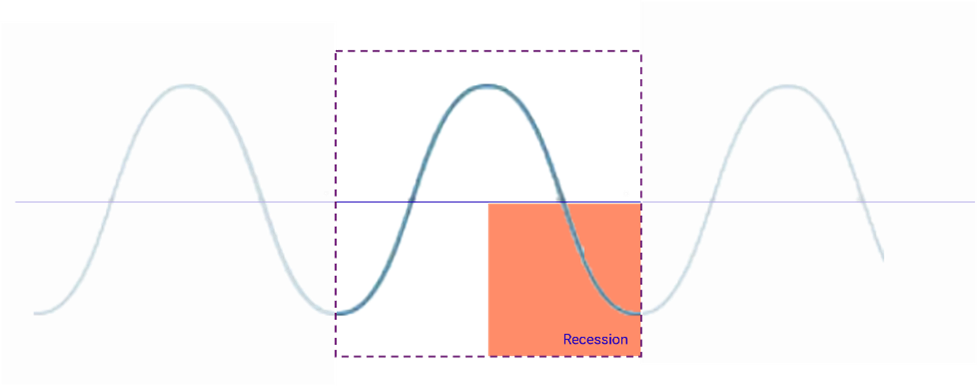

Recession – the indicator is below the long-term trend and has a downward trend.

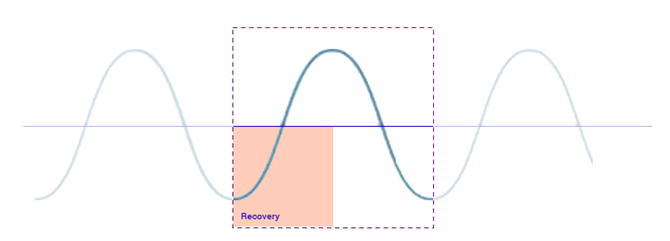

Recovery – the indicator is below the long-term trend and has an upward trend.

The indicators of the business cycle clock

The 14 indicators describe different parts of the economy and have been selected according to a number of criteria based on their cyclical characteristics. They are grouped in pairs according to seven different subject areas. Some indicators are more of a leading nature (e.g. consumer confidence indicator) and some are lagging (e.g. employment and hours worked).

|

Indicators |

Frequency |

Source |

|

A. GDP |

|

|

|

A1 – GDP indicator monthly |

Monthly |

Statistics Sweden |

|

A2 – GDP quarterly |

Quarterly |

Statistics Sweden |

|

B. Private sector |

|

|

|

B1 – Private sector production |

Monthly |

Statistics Sweden |

|

B2 – Orders in industry |

Monthly |

Statistics Sweden |

|

C. Trade and consumption |

|

|

|

C1 – Household consumption |

Monthly |

Statistics Sweden |

|

C2 – Retail trade durables |

Monthly |

Statistics Sweden |

|

D. Vehicle registration |

|

|

|

D1 – New registrations of passenger cars |

Monthly |

Statistics Sweden |

|

D2 – New registrations of lorries |

Monthly |

Statistics Sweden |

|

E. Foreign trade |

|

|

|

E1 – Exports of goods |

Monthly |

Statistics Sweden |

|

E2 – Imports of goods |

Monthly |

Statistics Sweden |

|

F. Labour market |

|

|

|

F1 – Employment |

Monthly |

Statistics Sweden |

|

F2 – Hours worked |

Monthly |

Statistics Sweden |

|

G. Economic tendency survey |

|

|

|

G1 – Private sector demand |

Monthly |

National Institute of Economic Research |

|

G2 – Consumer confidence indicator |

Monthly |

National Institute of Economic Research |

In the interactive business cycle clock, you can also see time series diagrams for the different indicators. For most indicators, data are available from January 2000. For the indicators employment, hours worked and private sector demand data are only available from January 2001.

Example: GDP indicator monthly

GDP indicator monthly can be considered as the main indicator of the state of the Swedish economy.

The business cycle clock is updated once a month in connection with the publication of “The Swedish economy – a statistical perspective”. Each update may also affect previous values.

How to interpret the business cycle clock

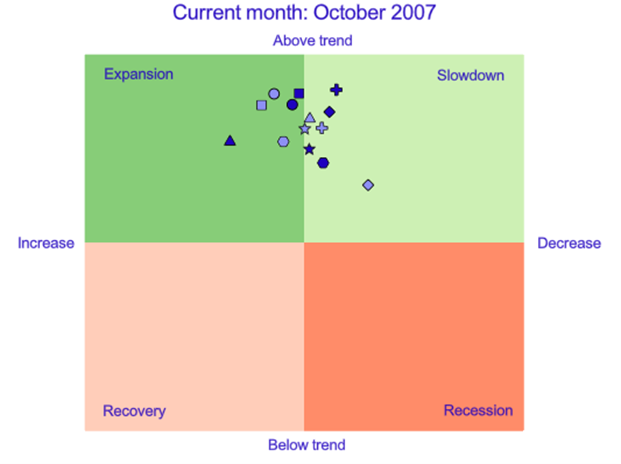

Example from October 2007, when the economy was booming

The diagram shows that all indicators are clearly above their long-term trend. The economy is booming. Some indicators have peaked and are moving downwards (slowdown phase), while others are still on the rise (expansion phase). GDP indicator monthly is just on the border between expansion and slowdown, which means that it is at the peak of the boom.

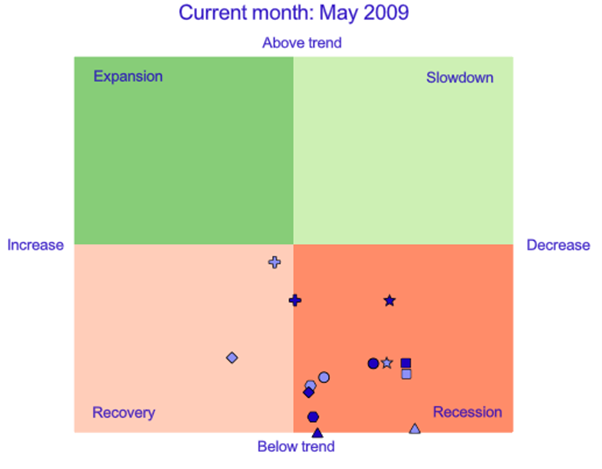

Example from May 2009, when the economy was in recession

The diagram shows that all indicators are below their long-term trend. The economy is in recession. Most indicators are in decline (recession phase), while some have begun to rise (recovery phase). GDP indicator monthly is in the recession phase.

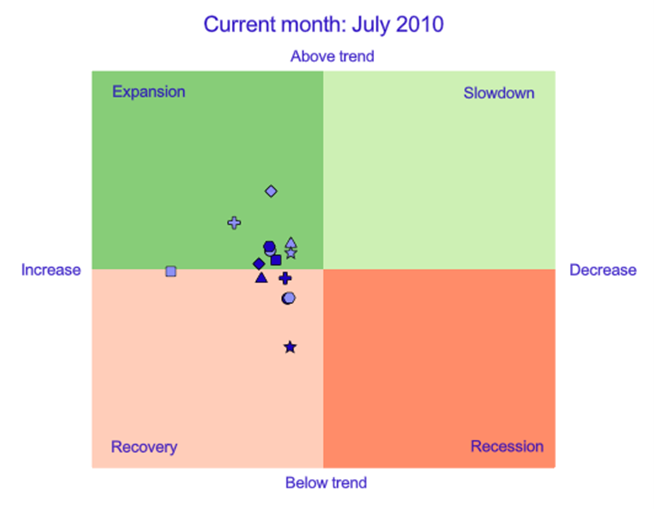

Example from July 2010, when the economy was on the upswing

The diagram shows a fairly even distribution between indicators that are above and below their long-term trend. All indicators are in the two left quadrants, which means that the economy is on the upswing. GDP indicator monthly has just left the recovery phase and entered the expansion phase.

More information

Instructions for the business cycle clock

Method description (Swedish only)

Business cycle clock – table in the statistical database

Business cycle indicators