“The coronavirus crisis is unlike previous crises”

| News

The extent of the consequences of the coronavirus crisis on the Swedish economy are difficult to fully anticipate. However, Statistics Sweden has compared the development in the first quarter with two previous crises: The 1990s crisis and the financial crisis of 2008–2009.

In difficult times when people have less money to spend, demand on goods and services dwindles. During the coronavirus pandemic, there is another reason for the decrease: people have had to physically distance, which makes it difficult to move about, meet, or consume as much as before. Demand diminishes and the market has to adapt by cutting back production. This also means the gross domestic product (GDP) risks declining.

“One might say that every crisis is unique, which makes it challenging to predict and prevent them,” says Johannes Holmberg, statistician at Statistics Sweden’ National Accounts unit.

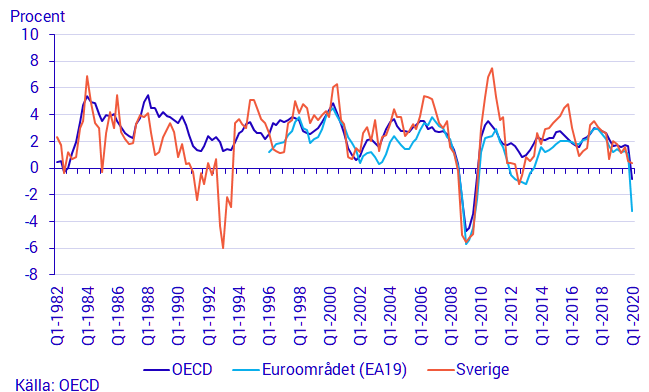

Despite the ongoing coronavirus pandemic, Sweden’s GDP growth has not been significantly affected in the first quarter of 2020. Households’ consumption fell sharply, but strong exports contributed upwards to Sweden’s GDP. It has increased marginally, both compared with the previous quarter and with the first quarter of 2019. Many other countries noted a large drop in GDP as early as the first quarter. The differences may be due to the fact that the restrictions introduced in Sweden were not as strict nor as early as in many other countries.

GDP growth

Percentage change compared with the corresponding quarter last year

The crisis in the 1990s

Statistics Sweden has compared the economic consequences of the coronavirus pandemic with the crisis in the early 1990s and the financial crisis of 2008–2009.

“The 1990s crisis was above all a Swedish phenomenon largely based on deregulations in the credit market. These led to a strong increase in lending and eventually, a broken property and housing bubble,” says Jenny Lunneborg, also a statistician at Statistics Sweden’s National Accounts unit.

This led to a crisis in the bank sector. Sweden’s fixed exchange rate regime at the time further exacerbated the situation. In November 1992, the Riksbank was forced to abandon attempts to defend the Swedish krona and introduced a floating exchange rate. The crisis also affected the real economy, that is, the production of goods and services - the size of GDP and employment. GDP declined for several years and unemployment rose sharply.

This severe crisis forced Sweden to implement comprehensive structural reforms. These included a new fiscal framework, which meant that central government finances could be rectified, the tax system was amended and the Riksbank was rendered independent. These reforms helped to pull the Swedish economy out of the crisis.

The 2008–2009 financial crisis

GDP plummeted in connection the 2008–2009 financial crisis, in Sweden as well as in other countries. At that point in time, the financial markets were integrated to such a degree that what began as a US crisis quickly spread to the rest of the world.

“There are some similarities with the coronavirus crisis, as the economy virtually ground to a halt, although this time events progressed much more quickly,” says Jenny Lunneborg.

In Sweden, the economy recovered more quickly than in most other countries. An important reason for this was that Sweden had much stronger central government finances than countries such as Italy and Greece.

“One difference that applied both then and now is that, during the financial crisis, mainly industry was hard hit, especially industries with large exports. The domestic economy and the services sector coped relatively well,” says Jenny Lunneborg.

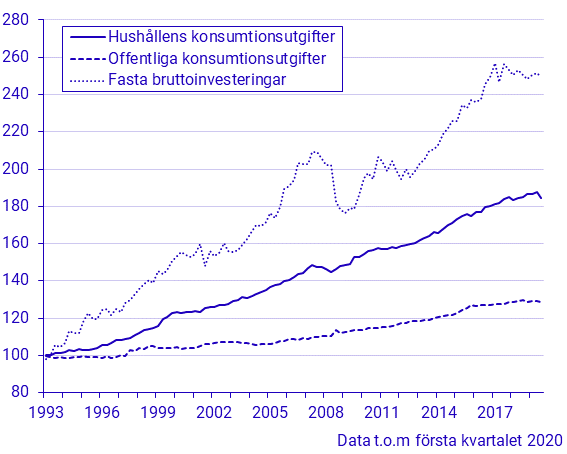

A significant fall in interest rates and fiscal stimulus meant households’ disposable income did not fall so much, despite rising unemployment. This was able to sustain consumption.

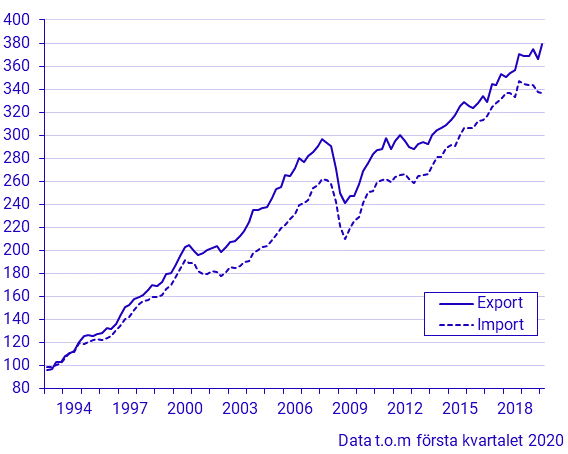

Exports and imports, as well as investments, decreased sharply. Neither household economy nor public consumption were affected to the same extent.

Exports and imports of goods and services (quarter 1993–)

Index year 1993=100, fixed prices, seasonally adjusted values

Consumption and investments (quarter 1993–)

Index year 1993=100, fixed prices, seasonally adjusted values

Essential difference

The different crises affected industries to varying degrees.

“The coronavirus crisis affects both goods and services production, but above all, services industries such as trade, hotels, restaurants, and transport. It is worth noting that growth was fairly strong in trade in recent years, while it has been more muted in hotels, restaurants, and transport,” says Johannes Holmberg.

An important difference between the financial crisis and the coronavirus outbreak is that the financial crisis began in the financial markets and spread to the real economy. In the current crisis, the real economy has been directly affected in the form of supply and demand disruptions.

“The upside is that the banks are better equipped than in previous crises and furthermore, the Riksbank, the Government and other authorities are also taking a number of measures to mitigate the effects on the economy,” says Johannes Holmberg.

Facts: GDP

Gross domestic product, GDP, is one of the most important socio-economic measures. It describes the size of a country’s economy and how it has changed over time.

In total, the Swedish economy - Sweden’s GDP - has increased at a steady rate since 1950. In this period, the size of Sweden’s economy has increased five-fold.

Links

Read more articles at scb.se on how the coronavirus outbreak is affecting society

Contact

- Telephone

- +46 10 479 45 11

- johannes.holmberg@scb.se

- Telephone

- +46 10 479 44 42

- jenny.lunneborg@scb.se