Environmental taxes 2020 and industry allocated environmental taxes 2019

Environmental tax revenue decreased in 2020

Statistical news from Statistics Sweden 2021-06-16 9.30

In 2020, environmental tax revenue amounted to SEK 99 billion, which is SEK 2 billion less than a year ago. Households are the largest contributors to the revenue from the carbon and energy tax, even though the manufacturing sector accounts for the most greenhouse gas emissions.

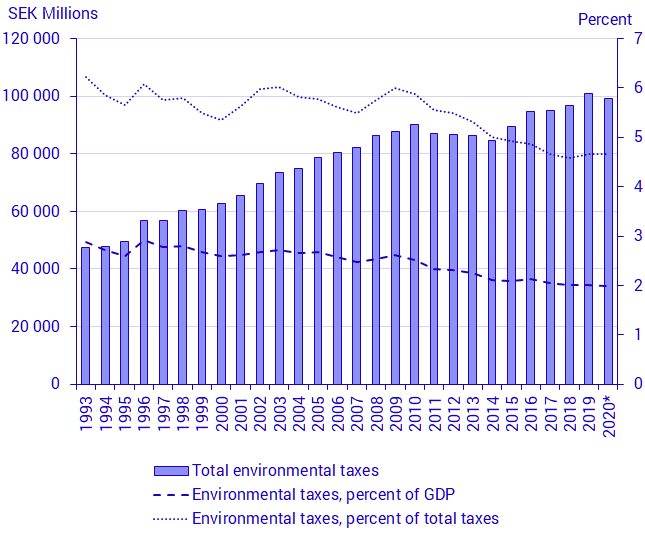

In 2020, total environmental tax revenue amounted to SEK 99 billion, which corresponds to 2 percent of GDP. In 2020, government tax revenue from environmental taxes decreased by SEK 2 billion, compared with 2019. Environmental tax revenue doubled between 1993 and 2020. However, as a percentage of GDP and total taxes, environmental tax revenue has had a decreasing trend since 1993, which means that environmental taxes are not rising at the same rate as other parts of the economy and total taxes.

Two new environmental taxes were introduced in 2020 – the waste incineration tax and the tax on plastic carrier bags – and generated revenue amounting to SEK 0.2 billion each during the year. In 2020, the COVID-19 pandemic affected the revenue from some environmental taxes, such as the tax on air travel, which decreased due to reduced air travel.

* GDP and total taxes figures are preliminary.

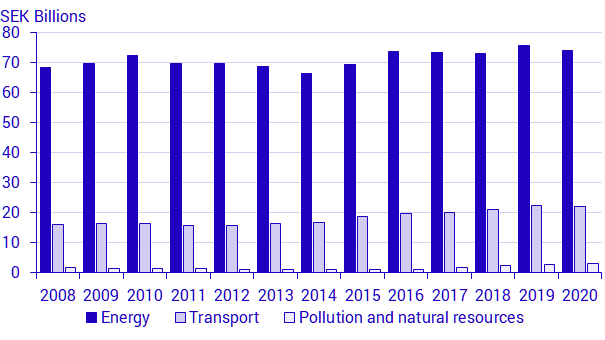

Energy taxes contribute most to environmental taxes

Environmental taxes are broken down into four categories: energy, transport, pollution and natural resources. The largest contribution to environmental taxes comes from energy taxes, which accounted for 75 percent of total environmental taxes in 2020. Energy taxes include energy tax on fuel, carbon dioxide tax, and energy tax on electricity. This is followed by transport taxes, which include vehicle tax, congestion tax, and tax on air travel. Transport taxes accounted for 22 percent of total environmental tax revenue in 2020.

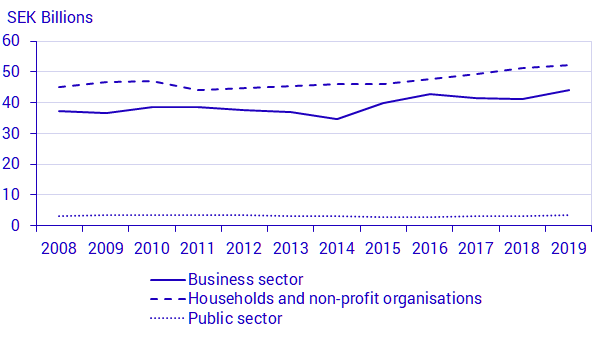

Environmental tax revenue increased from households, the business sector, and the public sector

The year 2019 is the most recent reference year for industry-allocated environmental taxes. In 2019, environmental tax revenue from households and from the public sector increased by 2 percent and by 10 percent, respectively, compared with the previous year. At the same time, environmental tax revenue from the business sector increased by 6 percent. This increase was in part due to higher revenue from emissions permits, which increased by SEK 0.9 billion, corresponding to an increase of 200 percent between 2018 and 2019. The higher revenue from emissions permits came from an increase in emission permit prices between these years.

Amendments in the energy and carbon tax rates for diesel led to a shift in revenue from carbon tax to energy tax between 2018 and 2019. Higher revenue from energy tax accounts the main increase in total environmental tax. Revenue from vehicle tax also increased between 2018 and 2019. This increase came from the bonus-malus system, introduced on 1 July 2018, which has generated more tax revenue.

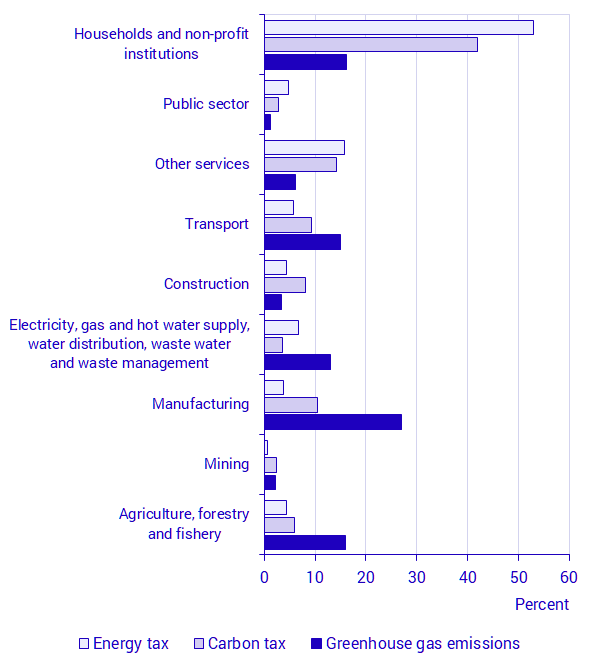

Households contributed the most to carbon and energy tax revenue

Households contributed 42 percent of the carbon tax revenue and 53 percent of the energy tax revenue in 2019, while they only accounted for 16 percent of Sweden’s greenhouse gas emissions that year. Meanwhile, in 2019, the manufacturing sector accounted for 27 percent of Sweden’s greenhouse gas emissions, but only accounted for 10 percent of the carbon tax and 4 percent of the energy tax. This is due to tax exemption rules for the manufacturing sector.

Revisions

The industry allocation of individual and total taxes has been revised since the previous publication. The tax on air travel and the chemical tax are now classified by industry. A residence adjustment has also been introduced, classifying taxes paid by foreign actors as ‘exports’.

For further information on the revisions that have been made, see the Environmental Accounts product page, under the heading Documentation (only available in Swedish).

Definitions and explanations

Environmental taxes

The definition of environmental tax used by Statistics Sweden was developed by Eurostat and the OECD. Today, this definition forms part of the international statistical standard in the SEEA Central Framework and enables comparative studies between different countries. Eurostat defines environmental tax as

“… a tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in the European system of accounts (ESA) as a tax.”

According to this definition, the tax base – rather than the intent or the name of the tax – determines whether the tax is defined as environmental. The ESA is a framework of guidelines for calculating national accounts used by European Union Member States.

European statistics

Next publishing will be

The next publication on the industry allocated environmental taxes to 2020 will take place in 2022.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.