Environmentally motivated subsidies and preliminary environmental tax revenue 2019

Environmental tax revenue continued to increase in 2019

Statistical news from Statistics Sweden 2020-05-19 9.30

Revenue from environmental taxes continued to increase in 2019 and amounted to SEK 101 billion. This increase is due to increased revenue from energy taxes and taxes on transportation. Environmentally motivated subsidies decreased by 17 percent, and amounted to SEK 11 billion in 2019.

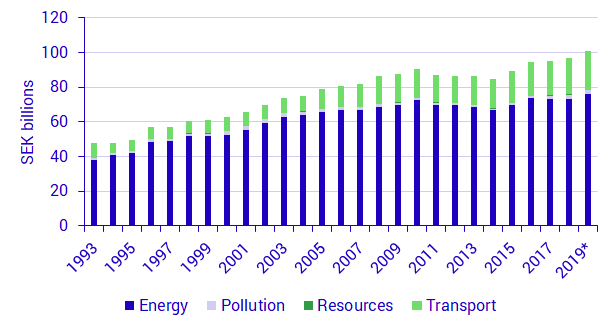

Environmental tax revenue to the Government amounted to SEK 101 billion, according to preliminary statistics. This is an increase of SEK 4 billion from 2018, which corresponds to an increase of 4.1 percent. Following several years of decreasing or static environmental tax revenue in the period 2011–2014, revenue has had an upward trend. Environmental tax revenue in 2019 was the highest ever since the beginning of the time series in 1993.

In 2019, revenue from energy tax on fuels increased by SEK 1.3 billion, which corresponds to 5 percent. Energy tax on electricity increased by SEK 1.0 billion, which corresponds to 4 percent. At the same time, revenue from the carbon dioxide tax decreased by SEK 0.8 billion, which corresponds to 4 percent. These developments are the result of amended tax rates and revised opportunities for tax exemption. Revenue from emission allowance trading increased by SEK 0.9 billion, which corresponds to 202 percent, mainly due to increased prices.

Revenue from the tax on air travel, introduced in 2018, increased by SEK 0.5 billion. This tax aims to decrease the climate impact from aviation. Revenue from the vehicle tax increased by SEK 0.8 billion. This increase is in part due to the introduction of the bonus-malus system, which entails a higher vehicle tax during the first three years for light vehicles with CO2 emissions exceeding 95 grams per kilometre. The introduction of this system led to a sharp increase in the number of new passenger cars registered toward the end of 2018, which affected the vehicle tax in 2019.

Statistics on environmental taxes have been revised for the whole time series. Fees to the nuclear waste fund are no longer included as an environmental tax; rather, these funds are considered to belong to the nuclear plant companies. This revision is an alignment with EU regulations and with the latest revision of the national accounts.

*Figures for 2018 and 2019 are preliminary.

Environmental taxes in the EU

The taxes that apply and the amount of tax paid by EU citizens is decided at national level. The size and significance of environmental taxes varies across the countries.

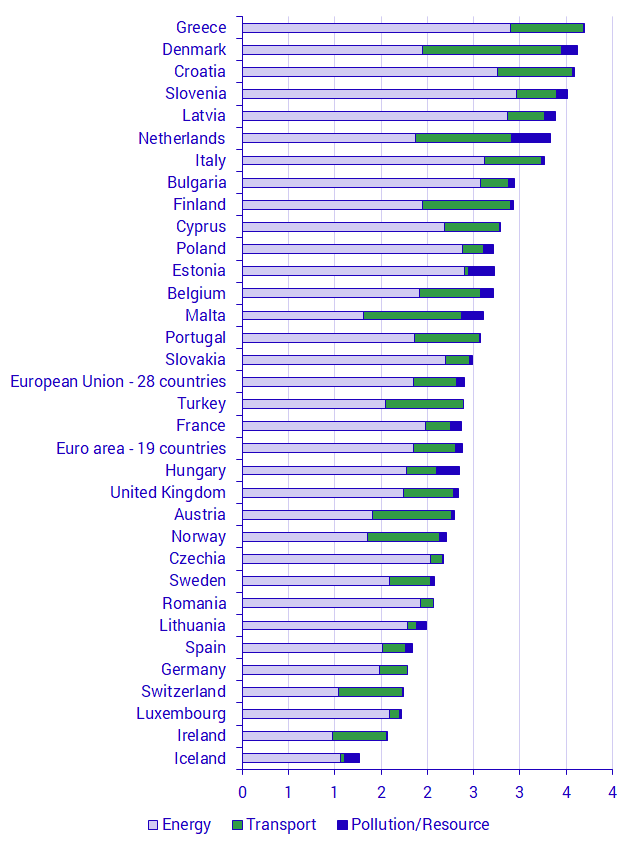

Statistics on environmental taxes are available in all EU Member States and the taxes are contained in the categories energy taxes, transport taxes, pollution taxes and resource taxes. In comparisons between countries, environmental tax revenue is often shown as a share of total tax revenue or GDP, to take into account the countries’ different sizes. Greece, Denmark and Croatia were the countries with highest environmental taxes as a share of GDP in 2018. Sweden is among the countries with lower environmental taxes as a share of GDP, at 2.1 percent.

A low or high share can depend on several factors. Environmental tax revenue depends on what environmental taxes apply, tax rates, exceptions in different sectors, as well as the use of the tax base. When the consumption of, for example, fossil fuels decreases, tax revenue also decreases. Even though Sweden often has high tax rates in relation to other countries on, for example, carbon emissions, other factors may also have an impact. Factors may include low tax incomes from transport taxes and a low share of fossil fuels in final consumption.

Environmentally motivated subsidies

Environmentally motivated subsidies include transactions that help reduce climate and environmental impact and improve natural resources management.

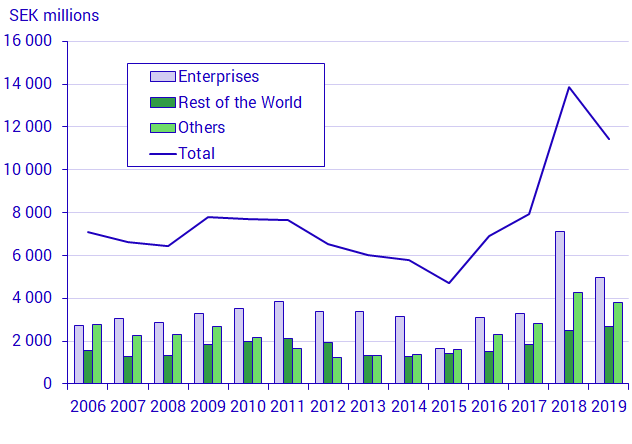

In 2019, environmentally motivated subsidies amounted to SEK 11.5 billion. This is a decrease of 17 percent compared with 2018. The most important reason for this decrease is that payments for climate investment, intended for use at local and regional level to decrease greenhouse gas emissions, have not been issued according to plan. Furthermore, new directives on how to apply the financial support for solar panels has affected the payments – repayments to the National Board of Housing, Building and Planning resulted in negative values.

These subsidies, that is, Government contributions to investments and consumption, are allocated to various actors, both nationally and internationally. Subsidies to national enterprises, non-profit organisations and other government agencies account for 77 percent of total subsidies. National subsidies decreased and amounted to SEK 8.8 billion in 2019. Subsidies to the rest of the world, in the form of aid and international cooperation on the environment and climate, increased and amounted to SEK 2.7 billion in 2019.

The group “Others” contain support to households, public sector and non-profit organisations.

Environmentally related subsidies revised

In 2020, a minor revision of the statistics was conducted. Updated statistics from the Swedish Board of Agriculture and the Swedish International Development Cooperation Agency resulted in revised calculations of shares for international aid and environmentally related subsidies in agriculture.

Definitions and explanations

Environmental taxes

The definition of an environmental tax that Statistics Sweden applies was developed by Eurostat and the OECD. The term is included in the global SEEA Central Framework statistical standards and enables comparative studies between different countries. The definition is:

“...it has been chosen to single out the tax base that seems to have a particular environmental relevance, and to consider all taxes levied on these tax bases as environmentally related regardless of motives behind their introduction, their names etc.”

Consequently, based on this definition, the tax base determines whether or not a tax is defined as environmental.

Statistics Sweden has presented statistics on environmental taxes since 1993.

Environmentally motivated subsidies

Environmentally motivated subsidies are defined in accordance with the SEEA Central Framework statistical standards for environmental accounts. The definition that applies in Statistics Sweden’s environmental accounts is informed by the subsidy objective. Therefore, the definition used in the environmental accounts is broader than the one used in the national accounts, as the environmental accounts also include capital and current transfers and social benefits in kind.

For the environmental accounts, the primary source for the subsidy objective has been the Government’s Budget Bills for various years. These statistics are derived from the National Financial Management Authority’s calculations of the central government budget’s outcome, in which transactions are traced back to the government appropriations from which they came. In 2015, Statistics Sweden carried out a development project that reviewed the methodology of the statistics.

Statistics Sweden has presented statistics on environmentally motivated subsidies since 2000.

Next publishing will be

Environmental taxes, by NACE industries, 1993-2018 will be published on 2020-10-06.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.