Financial accounts first quarter 2019

Households’ wealth at a record level

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2019-06-19 9.30

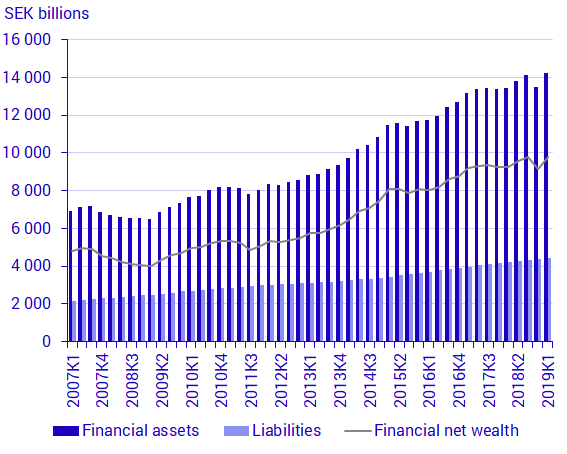

Households’ financial net wealth rose to a record high in the first quarter of 2019, following a fourth quarter in 2018 with a steep stock market decline. The upswing on the Stockholm Stock Exchange was the main contributor to the high level of net wealth, but new savings and a decline in the rate of loans also contributed.

Households’ financial net wealth, measured as financial assets minus liabilities, returned to record levels following the steep stock market decline in the fourth quarter last year. Households’ liabilities, which have doubled in twelve years, amounted to SEK 4 424 billion at the end of the first quarter of 2019. In the same period, households’ financial assets, from which non-financial assets are excluded, have more than doubled. At the end of the first quarter of 2019, households’ financial net wealth amounted to SEK 9 811 billion.

Source: Statistics Sweden

Sharp increase of households’ financial assets

Households’ financial assets consist mainly of shares, funds, tenant-owned apartments, bank deposits and pension savings. The market value of households’ assets increased sharply in the first quarter of 2019 as the Stockholm Stock Exchange rose by 12 percent and a large part of the financial assets consist of shares or are share-related. The market value of households’ assets in tenant-owned apartments also increased during the quarter, after declining market value in 2018.

High levels of household savings

Households’ financial savings reached a record level in the first quarter of 2019 and amounted to SEK 102 billion. This is the highest level of financial savings since the second quarter of 2014 and the highest level ever of savings in a first quarter. New savings in financial assets amounted to SEK 150 billion and liabilities increased by SEK 48 billion. During the quarter, households were cautious in the purchases of shares and funds. The amount of net purchases of tenant-owned apartments was also low. Instead, households saved in bank accounts and occupational pensions.

Liabilities, which mainly consist of loans, increased, albeit as a lower rate than earlier, and the annual growth rate for loans amounted to 4.9 percent.

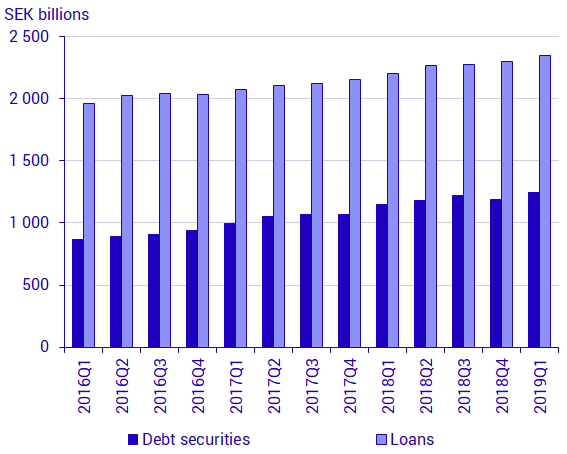

Non-financial corporations’ financing

In the first quarter of 2019, non-financial corporations’ borrowing increased, both via loans in monetary financial institutions and borrowing via issued debt securities. Loans remain non-financial corporations’ primary source of financing, although issued debt securities has gradually increased in recent years. In the past three years, borrowing via debt securities has increased by 44 percent, while borrowing via loans in monetary financial institutions increased by 19 percent in the same period. Non-financial corporations’ borrowing through loans in monetary financial institutions and issued debt securities amounted to SEK 3 588 billion at the end of the first quarter of 2019.

Source: Statistics Sweden

Revisions

In connection with this publication, revisions were made for all quarters in 2018. The largest revisions concern the rest of world sector and General Government. In addition, there were comprehensive revisions in the first quarter of 2019 with regard to the household sector, compared with the May publication of the Savings Barometer. Information on tax accrual, occupational pensions and funds were the focus of the revisions.

More information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial accounts. Financial assets and liabilities are collected from the Financial accounts and are thereby consistent with the values published in the Financial accounts.

For further information:

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as changes in savings and wealth for different economic sectors. The financial accounts’ financial savings, net lending/net borrowing, are calculated as the difference between transactions in financial assets and transactions in liabilities. Net lending/net borrowing are measured as the difference between income and costs in the non-financial accounts, which, like the financial accounts, form part of the national accounts. However, financial accounts and non-financial sector accounts are based on different sources, which gives rise to differences.

Next publishing will be

The next press release in this series is scheduled for publication on 2019-09-24 at 09.30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.