Financial Accounts third quarter 2022

Loan financing increasingly important for non-financial corporations

Statistical news from Statistics Sweden 2022-12-15 8.00

In the third quarter of 2022, non-financial corporations increased their loan financing, while interest in issuing bonds remained moderate. Households made net purchases of equity funds and reduced their new borrowings. The growth rate of households’ loans fell back to the pre-pandemic level.

Non-financial corporations’ shift from issuances to loans continued during the quarter

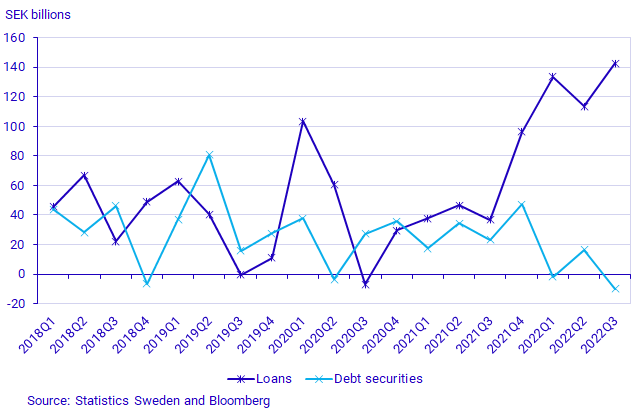

During the year, Swedish companies have used loans as a source of financing to a much greater extent than issuances of debt securities. For the third quarter, loan financing rose to SEK 143 billion, while financing in the debt securities market declined to SEK -10 billion.

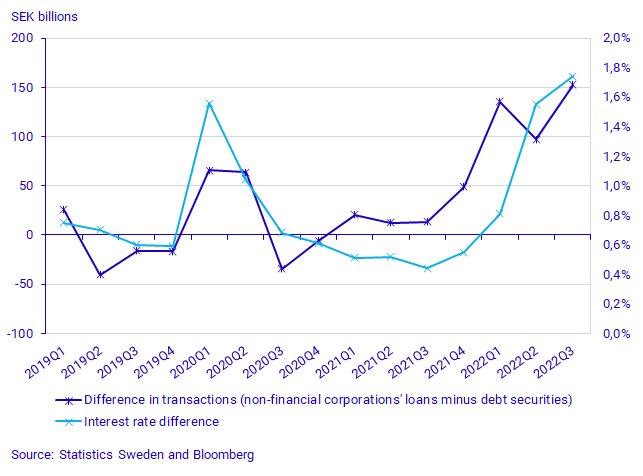

Higher inflation has led to both higher interest rates in general and a greater spread in interest rates between corporate and government bonds. The cost of financing – that is, the interest rate – is an important variable in companies’ choice of a financing source. The difference between the expected short rate and average interest rates on investment-grade bonds with different maturities, issued in Swedish kronor by non-financial corporations, has increased each quarter in recent years. The difference at the end of the third quarter of 2022 was 1.74 percentage points. If this is placed in relation to the difference in the companies’ financing sources: transactions in bank loans less transactions in debt securities, the relationship is shown in the diagram below.

The series shows the difference between corporate bond rates and the average expected short rate over the tenor of the bond, measured using swap rates.

“When the difference has increased, as we saw for instance during the outbreak of the covid-19 pandemic and when Russia invaded Ukraine, the companies have, to a greater extent, raised financing through loans rather than by issuing bonds on the market,” comments Jonas Holm, Economist/Statistician at the Financial Accounts.

Households continued to make net purchases of equity funds

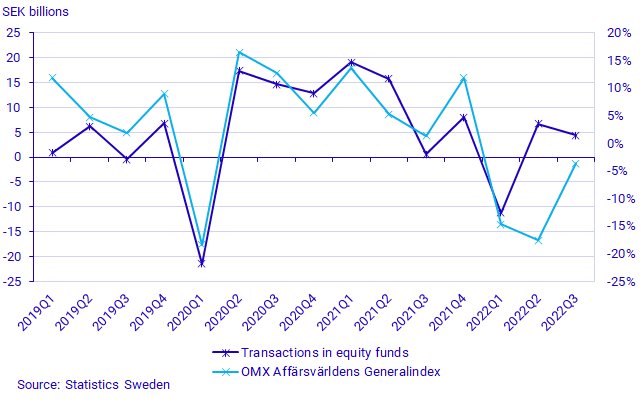

Households continued to make net purchases of equity funds in the third quarter of the year. Transactions amounted to SEK 4 billion, compared with SEK 7 billion in the previous quarter. Since 2000, the average of households’ net purchases of equity funds is just shy of SEK 1 billion per quarter.

Households’ transactions in equity funds have been significantly more volatile in recent years. In the first quarter of 2020, households sold equity funds net to a value of SEK 21 billion – a trough level. The greatest net purchase of equity funds occurred in the first quarter of 2021 and amounted to SEK 19 billion, one year after the trough.

A clearly positive relationship emerges when households’ transactions in equity funds are placed in relation to stock market performance from 2019 onwards. The substantial net sales in the first quarter of 2020 and 2022 coincide with heavy drops in the stock market of 18 and 15 percent, respectively, according to the OMX Affärsvärlden general index. A probable explanation for this relationship is that households react to international unrest, the pandemic and war in Sweden’s proximity by selling off equity funds.

The growth rate of loans continued to decline

The annual growth rate of households’ loans continued to fall during the quarter and amounted to 5.2 percent at the end of the third quarter of 2022, the lowest growth rate since the start of the pandemic. New borrowings for the third quarter amounted to SEK 33 billion, which is a drop of 41 billion compared to the previous quarter.

The reduced borrowings was one of the main reasons why savings ended up at SEK 35 billion, which is relatively high for a third quarter. This is a relatively large adjustment of the savings of SEK 76 billion that were published in the latest Savings Barometer for the third quarter of 2022. The main reason for the difference is tax accruals, which have been revised by almost SEK 40 billion.

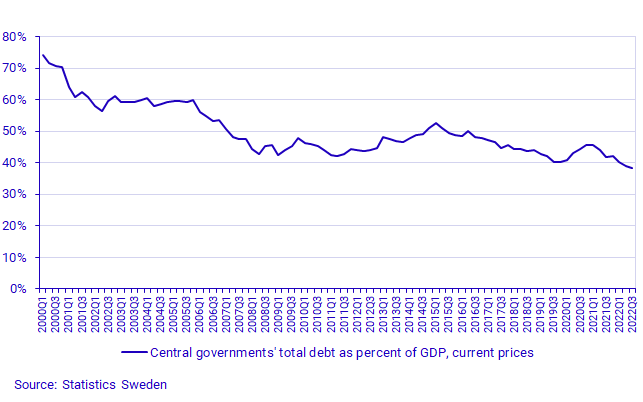

Government’s debt ratio lower than at the start of the pandemic

The financial savings of regions and municipalities remained positive for the third quarter of 2022, amounting to SEK 13 billion. This is a decline in savings of SEK 16 billion compared to the previous quarter. One reason for the lower savings was the continued reduction in state pandemic support measures.

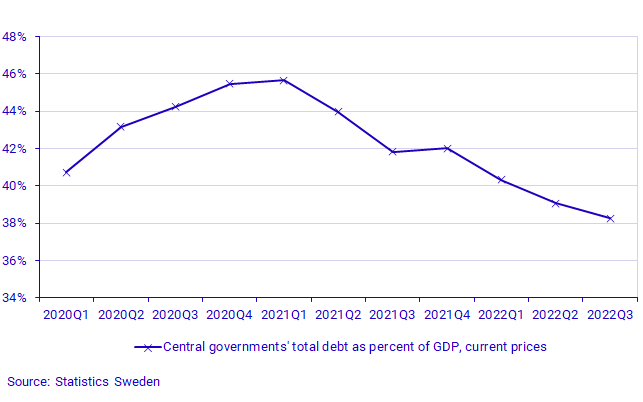

Government savings for the third quarter of 2022 were negative again and the deficit was SEK 4 billion. Compared with the previous quarter, this was a decrease of SEK 46 billion. Nonetheless, the government's debt ratio – government debt at market value divided by GDP in current prices – continues to decline. At the end of the third quarter, the debt ratio was 38 percent, which is 3 percentage points lower than in the first quarter of 2020, at the start of the pandemic.

Looking at the entire time series, starting in the first quarter of 1996, the debt ratio at the end of the third quarter of 2022 was at its lowest level since the start of the time series.

Revisions

When calculating the third quarter of 2022, annual and quarterly statistics have been revised for the period Q12019–Q22022. The foreign sector has been revised as of the first quarter of 2019 with new information from the balance of payments. Derivative transactions have been revised for the second and fourth AP Funds for the first and second quarters of 2022, which has affected savings in social security funds.

Definitions and explanations

The financial accounts aim to provide information about financial assets and liabilities, as well as about changes in financial savings and wealth for various economic sectors.

The financial accounts’ financial savings are calculated as the difference between transactions in financial assets and transactions in liabilities. In the non-financial sector accounts which, like the financial accounts, form part of the National Accounts, financial savings are calculated as the difference between income and costs. However, the financial accounts and non-financial sector accounts are based on different sources, which causes disparities between the products.

In the Financial Accounts, the government debt is calculated differently from the government debt metric that is most frequently reported and which is calculated according to the convergence criteria – the ‘Maastricht debt’. The definition of the Maastricht debt does not include all financial instruments, the instruments are presented in nominal value and the liabilities for government administration are consolidated. The government debt in the Financial Accounts is unconsolidated and includes all financial instruments at market value.

In addition to the government agencies, the government administration sector also includes certain state foundations and state-owned companies. Government administration does not include entities within the retirement pension system. Instead, they make up the social security funds sector. Municipal administration includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations and certain municipal foundations and certain municipally or regionally owned companies.

Further information: The National Wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For further information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news bulletin is scheduled for publishing on 16/03/2023 at 08.00.

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.