Shareholder statistics, December 2022

Shareholder wealth fell in 2022 – after three years of growth

Statistical news from Statistics Sweden and Swedish Financial Supervisory Authority 2023-03-02 8.00

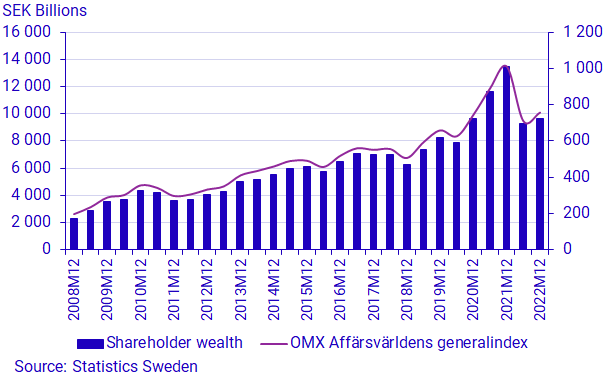

A large increase in the Stockholm Stock exchange during parts of 2020 and throughout 2021 were followed by a substantial decline in 2022. As a result, shareholder wealth has come down from its peak in 2021.

Developments in 2022 in brief

- During the year, the market value of Swedish listed shares fell by SEK 3,868 billion compared to 2021. This represents a decrease of 29 percent. It was the first time since 2018 that shareholder wealth has fallen in full-year terms.

- Shareholders who have an annual income of SEK 1,000,000 or more increased their ownership measured as a share of the total wealth of Swedish listed shares. It was 64 percent at the end of the year.

- For the first time since the start of the time series, the value of the median portfolio of women was greater than that of men.

During the second half of 2022, the Stockholm Stock Exchange, according to OMX Affärsvärldens Generalindex, rose by 7 percent and shareholders wealth increased from SEK 9,300 billion to SEK 9,614 billion. Despite this increase, shareholder wealth declined in 2022, driven by a broad stock market decline in the first half of the year.

Large volatility in stock wealth in a short period of time

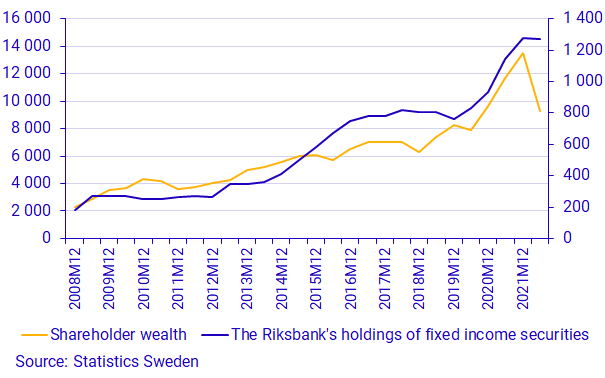

In the first quarter of 2020, when the pandemic broke out, the world's stock markets fell sharply due to concerns about how the world economy would be affected. In Sweden, the Stockholm stock exchange fell by 18 percent in the first quarter of 2020. To reduce the effects of the pandemic on the Swedish economy, the Riksbank expanded its purchases of fixed income securities until the end of 2021, with the aim of increasing liquidity and reducing the risk of rising interest rates. According to the Riksbank, the value of these asset purchases amounted to SEK 668 billions. During 2020 and 2021, with low market interest rates and a large supply of liquidity in the financial system, the stock market increased and the shareholder wealth rose by 64 percent. A positive correlation can be distinguished in the graph below, where total holdings in fixed income securities and shareholder wealth moves in the same direction.

At the end of 2021, inflation started to pick up and then continued to rise in 2022, which was a year of great economic uncertainty. In order to suppress rising inflation, the Riksbank raised its key interest rate several times and asset purchases also began to be scaled down. As a result, interest rates have increased and the stock market has decreased.

- Historically low interest rates have led to a large increase in share prices, which has increased the wealth of those who own shares in listed companies in Sweden. This is perhaps most evident in 2020 and 2021. However, the following year has been characterized by economic uncertainty with rising inflation and higher interest rates. We are now seeing a decline in shareholder wealth for 2022," says Jonas Holm Economist/Statistician at Statistics Sweden.

More individuals with higher incomes join the stock market

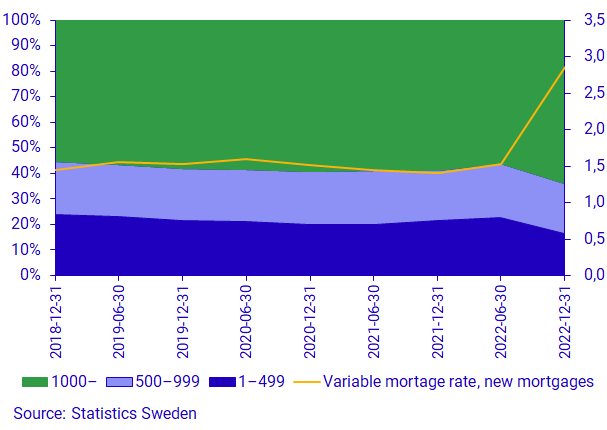

During the second half of 2022, the number and proportion of shareholders with an annual income of SEK 499,000 or less has decreased. However, those with an annual income of SEK 500,000 or more have increased in both numbers and proportions.

In the second half of 2022, when household finances became more strained, with rising interest rates and a general price increase, changes can be seen in the ownership structure of income groups. The market share of those with more than 1 million in annual income increases, while it decreases for those with less than SEK 499,000 in annual income.

Women's median portfolio worth more than men's

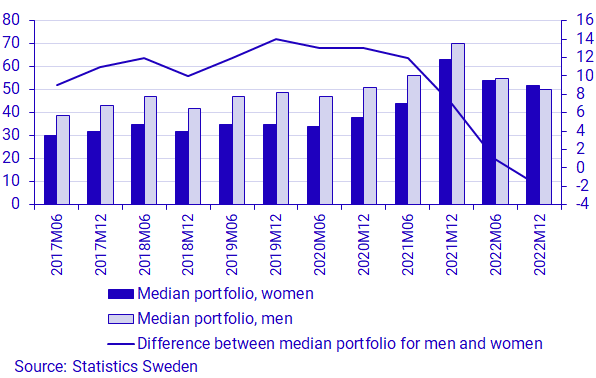

There is a wide spread among individuals' stock portfolios. This applies to both men and women. The mean value is significantly larger than the median value, which means that it is few individuals with large holdings who drive up the mean value. Therefore, the mean is not a very good central measure in this context. Instead, it may be interesting to look at the median portfolio that better represents the large number of men and women.

The time series of the median portfolio for men and women stretches back to the first half of 2017 and never has the value of the median portfolio for women been higher than for men. But at the end of 2022, the median value of women's portfolio amounted to SEK 52,000, which is SEK 2,000 more than men's. Previously, seen over the entire time series until the second half of 2022, men's median portfolio has on average been worth SEK 10,000 more than women's median portfolio. In particular, the gap started to decrease in the second half of 2021.

International ownership decreased

The international sector, still the largest ownership sector in Swedish listed companies with a market share of 38 percent, had a shareholder wealth of SEK 3,638 billion at the end of 2022. This is a decrease of 1 percentage point compared to the same period last year. The second largest ownership sector was financial companies with an ownership share of 30 percent, which amounted to SEK 2,908 billion.

Definitions and explanations

Information on final owners is not available for nominee-registered ownership through Swedish nominees if the holding is less than 501 shares in a company. Because of this, these holdings are not included when households’ shareholdings are broken down by income and age. To address this, the difference between the number of shares issued and the number of securities with a known final-owner is imputed. The difference is distributed between the household sector and non-profit institutions serving households. At the end of 2022, the imputed share in the household sector amounted to 13 percent of the total market value.

Information foreign nominees’ end customers is not available, as these are not included in the public register of shareholders.

Swedish marketplaces refer to OMX Stockholm, Spotlight Stock Market, NGM and First North. Unlisted classes of shares in listed companies are also included. Shares in foreign companies listed on the aforementioned marketplaces are included in the statistics from the year 2000 onwards.

Next publishing will be

Next publication date 2023-08-31

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.