Financial Accounts fourth quarter 2023

Households borrowed less and saved more

Statistical news from Statistics Sweden 2024-03-14 8.00

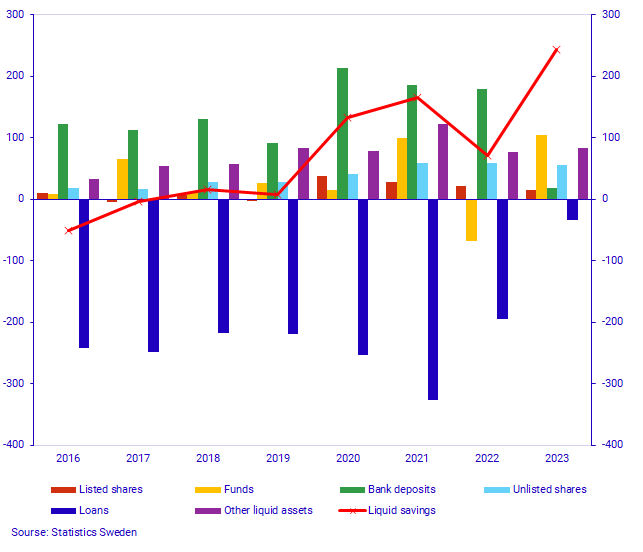

The fourth quarter of 2023 continued on the path set for households with very low new borrowing and another high listing for liquid financial savings. For the year 2023, liquid savings were historically high, while new borrowing amounted to SEK 34 billion.

Households’ liquid savings, i.e., their liquid financial assets minus liabilities, amounted to SEK 11 billion in the fourth quarter of 2023. During the quarter, households made net purchases of shares and funds and had net withdrawals from bank accounts. Households' net borrowing, i.e., newly taken loans minus amortized loans, was unusually low in the fourth quarter and amounted to SEK 2 billion. This is a decrease of SEK 8 billion compared to the previous quarter and a decrease of SEK 15 billion compared to the corresponding quarter in 2022.

Households’ liquid savings for the year 2023 amounted to SEK 244 billion, a very high value in historical perspective. This is significantly higher than in 2020–2022, when high net deposits in bank accounts received a lot of attention.

"It is easy to give savings in bank accounts a disproportionately large role in the discussion about savings. A common way of thinking is probably that if a lot of money disappears from households' bank accounts, savings will fall. But as we have seen in 2023, bank deposits were low but liquid savings were high. In the past year, the main reason for the increase in savings has not been household savings in liquid assets or the distribution across different forms of savings. Instead, it was the low level of net borrowing that boosted savings."

-Jonas Hallberg, Economist/Statistician, Financial Accounts

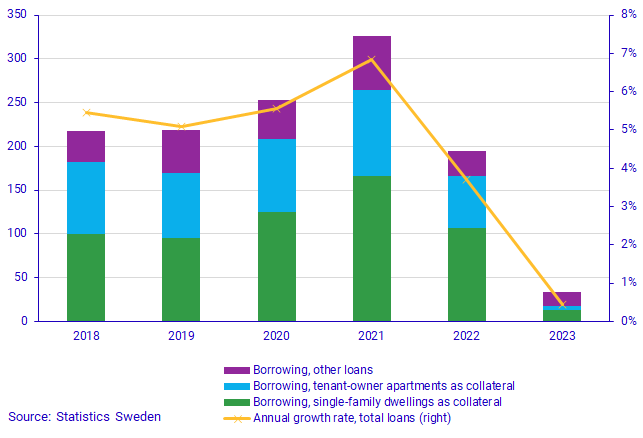

Amortizations to banks and housing credit institutions exceeded newly taken loans in the fourth quarter of 2023. This has happened only once before, during the first quarter of 1996 which is the first quarter of the time series. For the year 2023, new borrowings were only SEK 34 billion, compared to SEK 252 billion in 2020, SEK 326 billion in 2021 and SEK 195 billion in 2022. The annual growth rate of loans continued to decline and at the end of 2023 it was close to zero. This can be compared to the end of 2021 when the growth rate was almost 7 percent. Historically, households have mainly borrowed to purchase houses and tenant-owned apartments, but also for consumption.

Single-family dwelling houses refer to detached one- and two-dwelling houses as well as semi-detached houses, terraced and linked houses.

Liquid savings are affected in different ways depending on if loans are used for consumption, real investments, or financial investments. If loans are used for investments in financial assets, the effect on liquid savings is limited, while it decreases if loans are used for consumption and real investments.

Financing of non-financial corporations

In the fourth quarter of 2023, the value of non-financial corporations' financing via loans at monetary financial institutions, new loans minus amortization, were SEK -72 billion. It is a decrease compared to the previous quarter, when this value was SEK -7 billion, and a large decrease from the corresponding quarter last year, when this value was 31 billion.

Financing through interest-bearing securities, new issues minus maturities and repurchase, amounted to SEK -3 billion. This is SEK 38 billion lower than the previous quarter and SEK 33 billion lower than the corresponding quarter last year.

Total loans from monetary financial institutions amounted to SEK 2 876 billion at the end of the quarter. The value of debt securities issued amounted to SEK 1 506 billion.

Revisions

In connection with the publication of the Financial Accounts for the fourth quarter of 2023, revisions have been made back to 2020 in order to improve the statistics where new information has become available. The revisions affect both the annual and quarterly time series. Balance of payments has been revised back to 2020. For social security funds, transactions of Swedish listed shares in 2022Q4 have been revised to a value of SEK 18 billion. This affects net lending for 2022Q4 and the full year 2022. Changed accounting principle for municipalities and regions in terms of financial leasing has led to revisions of the standing value for long-term loans of SEK 12 billion 2020 onwards. This also creates a break in the time series between 2019 and 2020. For 2023, new annual values have been delivered for certain financial instruments, such as derivatives that affect liquid financial savings. Financial market statistics have had minor revisions back to 2021Q4. For the sources Securities Holdings (VINN) and Securities Issued (SVDB), 2023Q3 has been revised.

Definitions and explanations

In the statistical news, reference is made to the liquid savings of households. It is calculated as the difference between transactions in financial assets and liabilities excluding accruals (tax accruals, occupational pensions and other technical provisions). For more information, see the Financial Accounts Quality Declaration, section Variables 1.2.2.

The purpose of financial accounts is to provide information on financial assets and liabilities, as well as changes in net lending and financial wealth for different sectors of society. The statistics are presented in current prices and do not take inflation into account.

Net lending in financial accounts is calculated as the difference between transactions in financial assets and liabilities. In the Real Sector Accounts, which, like the Financial Accounts, are part of the National Accounts, net lending is calculated as the difference between income and expenses. However, financial accounts and real sector accounts are based on different sources, which gives rise to differences between products.

In the Financial Accounts, central government debt is calculated differently from the most commonly reported measure of government debt, which is calculated according to the convergence criteria, the so-called Maastricht debt. The definition of the Maastricht debt does not include all financial instruments, the instruments are presented at nominal value and the liabilities for government administration are consolidated. Central government debt in the Financial Accounts is not consolidated and includes all financial instruments at market value.

In addition to government agencies, the central government sector also includes certain state foundations and certain state-owned companies. Central government does not include units of the old-age pension system. Instead, they make up the social security funds sector. Municipal administration includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations, as well as certain municipal foundations and certain municipally or regionally owned companies.

Further information: National wealth

In connection with the publication of the Financial Accounts, the National Wealth is also published, which contains annual data for both real and financial assets. The financial assets and liabilities are derived from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For further information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news in this series is scheduled for publishing on 2024-06-20 at 08.00

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.