Financial Accounts third quarter 2024

Households reduced their savings in bank accounts

Statistical news from Statistics Sweden 2024-12-19 8.00

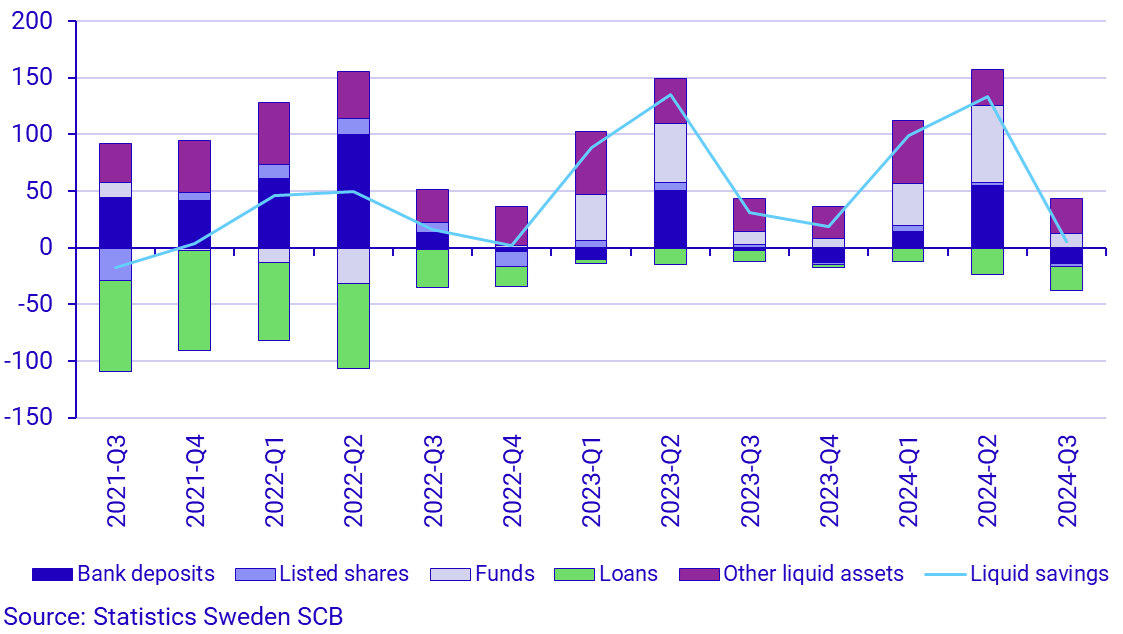

Household liquid savings were low in the third quarter of 2024 and were characterised by savings in funds, net withdrawals from bank accounts and net borrowing at the same level as the previous quarter.

Household liquid savings, i.e. their transactions in financial liquid assets minus liabilities, amounted to SEK 6 billion in the third quarter of 2024. Household liquid savings have a seasonal variation and are usually lower in the third quarter. In the third quarter of 2024, households saved SEK 13 billion in funds and had net withdrawals from bank accounts of SEK 14 billion. Net borrowing, i.e. new loans minus amortisation, amounted to SEK 21 billion. This is a decrease of SEK 2 billion compared to the previous quarter, but an increase of SEK 11 billion compared to the corresponding quarter in 2023.

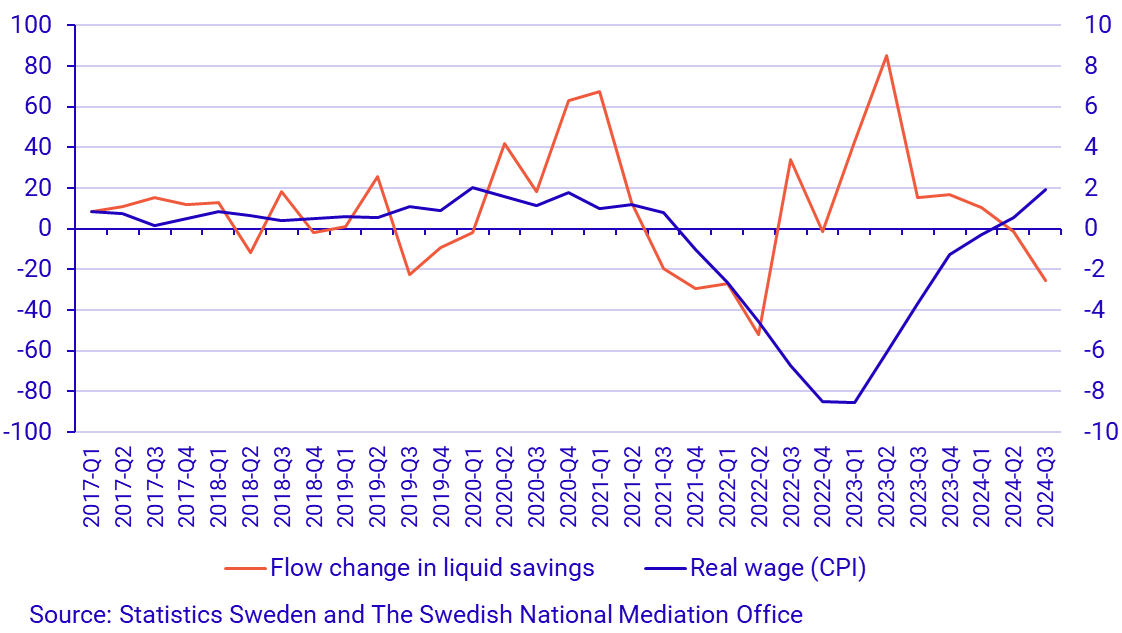

In the chart below, you can see that households' real wages have been squeezed by inflation in 2022 and 2023, which has also clearly impacted savings. The year-on-year change in liquid savings, i.e. the difference between liquid savings in a given quarter and the corresponding quarter of the previous year, was negative in the initial phase of rising inflation, which is not unexpected as costs increase without a corresponding increase in income.

"We see a clear saving impulse from households in the second half of 2022 and into 2023, probably because many then start to plan for a longer period of high inflation."

-Jonas Hallberg, Financial Accounts

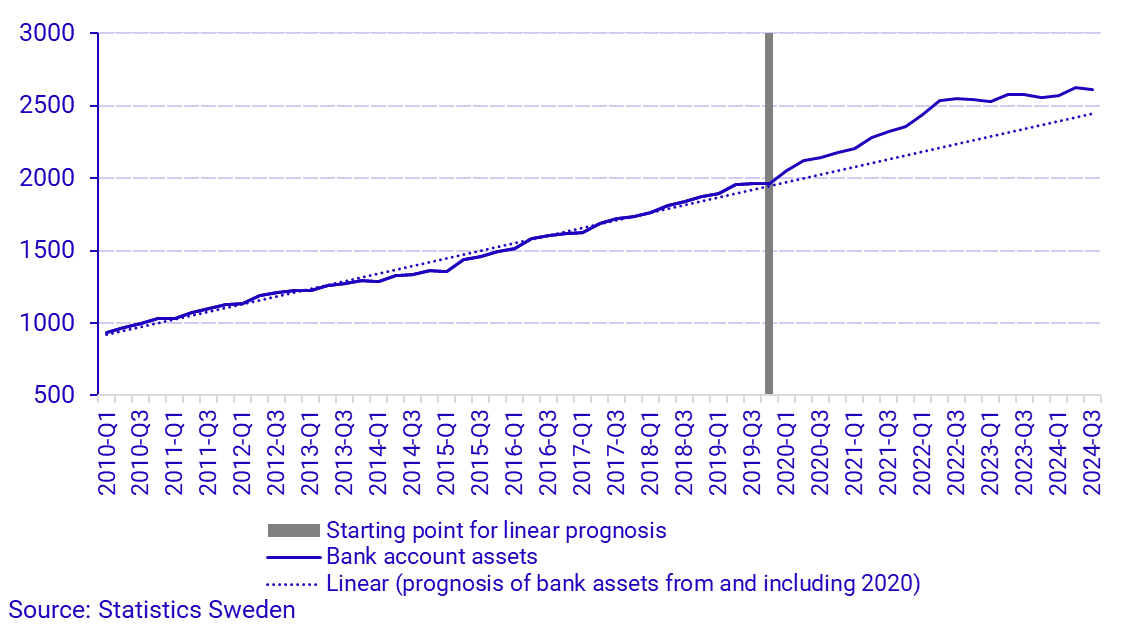

You can also clearly see in the chart the high level of savings during the pandemic. This was probably due to the fact that many of households' desired consumption opportunities, such as restaurant visits and travel, became unavailable, while incomes remained relatively stable. A large part of these savings remained in bank accounts rather than being used for consumption or investments.

"Since the end of the pandemic, households have made net withdrawals from their bank accounts on several quarters, which was previously uncommon. One question that has arisen is how large reserves households actually have? If we look historically at households' assets in bank accounts, they have increased in a predictable way from 2010 until the beginning of the pandemic. During the pandemic, households saved more in bank accounts than before and built up a buffer that they now seem to have used for a period."

-Jonas Hallberg, Financial Accounts

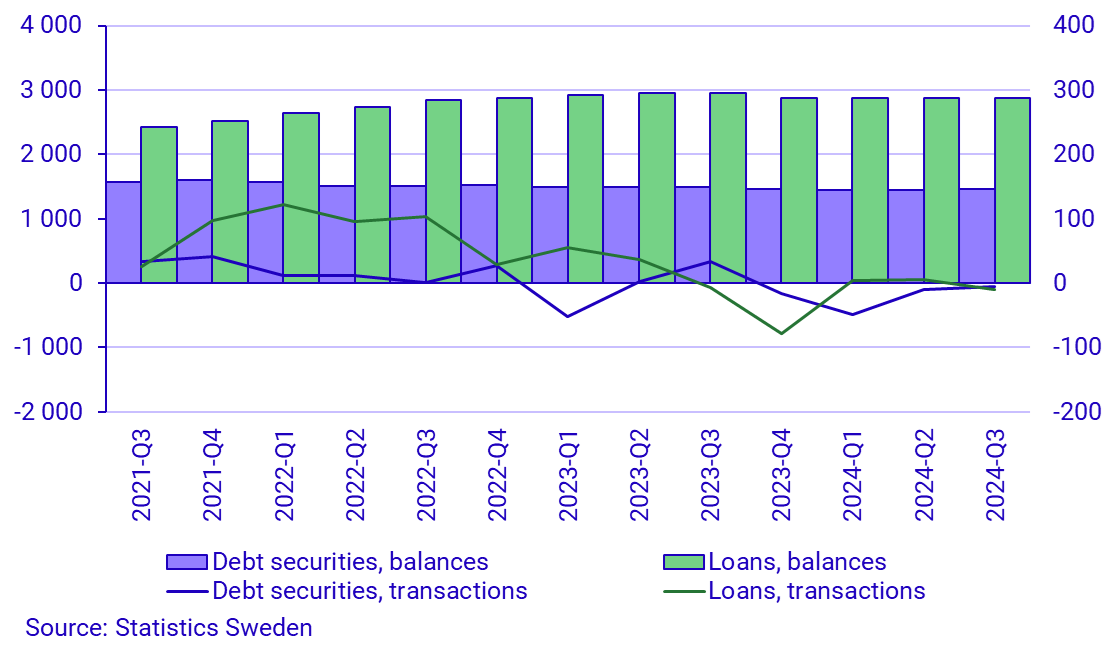

Financing of non-financial corporations

In the third quarter of 2024, the value of non-financial corporations' financing through loans, i.e. new loans minus amortisation from monetary financial institutions, was SEK -10 billion. This is a decrease of SEK 16 billion compared with the previous quarter and a decrease of SEK 3 billion from the corresponding quarter last year.

Financing through interest-bearing securities, i.e. through new issues minus maturities and repurchases, amounted to SEK -5 billion. This is SEK 5 billion higher than in the previous quarter and SEK 39 billion lower than in the corresponding quarter last year.

Total loans from MFIs amounted to SEK 2 871 billion at the end of the quarter. The value of issued debt securities amounted to SEK 1 468 billion.

Revisions

In the publication of the Financial Accounts for the third quarter of 2024, revisions have been made back to 2020 in order to improve the statistics where new data have become available. The revisions affect both the time series for years and quarters. The foreign sector has been revised back to 2021 with new data from the Balance of Payments, where the outcome of the annual survey for direct investments has resulted in revisions in financial transactions and balances. These are mainly major revisions to the financial instruments unlisted shares, inter-company loans and derivatives.

Definitions and explanations

In the statistical news, reference is made to the liquid financial savings of households. It is calculated as the difference between transactions in financial assets and liabilities excluding accruals (tax accruals, occupational pensions and other technical provisions). For more information, see the Financial Accounts Quality Declaration, section 1.2.2.

The aim of financial accounts is to provide information on financial assets and liabilities as well as changes in financial savings and financial wealth for different sectors of society. The statistics are presented in current prices and do not take inflation into account.

The financial savings in financial accounts is calculated as the difference between transactions in financial assets and liabilities. In the Real Sector Accounts, which, like the Financial Accounts, are part of the National Accounts, financial savings are calculated as the difference between income and expenses. However, financial accounts and real sector accounts are based on different sources, which gives rise to differences between these two products.

In the Financial Accounts, the government debt is calculated differently from the government debt metric that is most frequently reported and which is calculated according to the convergence criteria – the ‘Maastricht debt’. The definition of the Maastricht debt does not include all financial instruments, the instruments are presented in nominal value and the liabilities for government administration are consolidated. The government debt in the Financial Accounts is unconsolidated and includes all financial instruments at market value.

In addition to the government agencies, the government administration sector also includes certain state foundations and state-owned companies. Government administration does not include entities within the retirement pension system. Instead, they make up the social security funds sector. Municipal administration includes primary municipal authorities, regional authorities (formerly county council authorities), municipal associations and certain municipal foundations and certain municipally or regionally owned companies.

More information: National wealth

The National Wealth, which contains annual data on non-financial and financial assets, is also published in connection with the publication of the Financial Accounts. Financial assets and liabilities are collected from the Financial Accounts and are thus consistent with the values published in the Financial Accounts.

For further information, see:

Nationalförmögenheten och nationella balansräkningar (in Swedish) (pdf)

Next publishing will be

The next statistical news will be published on 20/03/2025 at 08.00

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.