Savings Barometer, 3rd quarter 2021

Household savings rate remains high in the third quarter

Statistical news from Statistics Sweden 2021-11-18 9.30

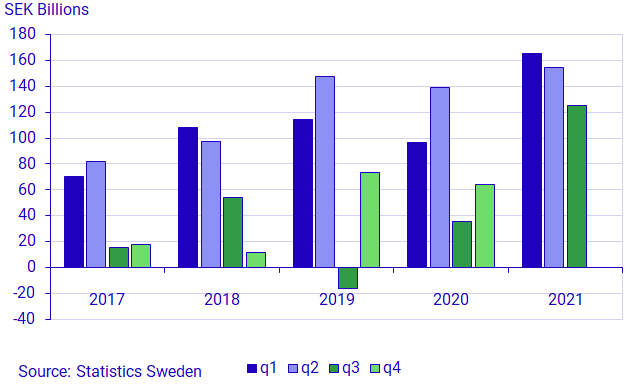

Households’ financial savings amounted to SEK 125 billion in the third quarter of 2021, which is SEK 89 billion more than in the corresponding quarter a year ago. The main contributions to the high level of savings came from insurance savings and the positive effect of tax accrual as well as bank deposits and funds. At the same time, households’ annual growth rate of loans continued to rise.

New savings in financial assets amounted to SEK 202 billion, while debts increased by SEK 77 billion in the third quarter of 2021, which resulted in SEK 125 billion in financial savings. Savings levels have been high during all three quarters of 2021, and financial savings in the third quarter was the largest savings in a third quarter since the start of the time series in 1996.

The seasonal variation in households’ financial savings means that savings in the third quarter are normally lower than in the first and second quarters. Households’ savings amounted to SEK 445 billion in the first three quarters of 2021, compared with SEK 271 billion in the corresponding quarters a year ago.

Major positive effect of tax accrual contributed to savings progression

The positive effect of tax accrual contributed SEK 83 billion to savings, which is the largest effect of tax accrual noted since the start of the time series. Tax accrual refers to taxes and social contributions that are booked at the time they arise rather than when they are actually paid.

Households’ private insurance savings were considerable and amounted to SEK 17 billion during the quarter. Private insurance savings have been large throughout 2021, with a peak in the first quarter at roughly SEK 25 billion. Savings in occupational pensions in the third quarter were on a level with the corresponding quarter a year ago and amounted to SEK 39 billion.

Sustained high level of savings in bank accounts

In the third quarter of 2021, savings in bank accounts amounted to SEK 42 billion, which is high for a third quarter. Savings in bank accounts have been high in recent years in general, despite low or nonexistent deposit rates. Households’ net deposits in bank accounts have remained high in 2021, although they have not reached 2020 levels. In the first three quarters of 2021, households’ net savings in bank accounts amounted to SEK 148 billion, which is SEK 28 billion less than in the corresponding period in 2020, but SEK 59 billion more than in 2019.

Households sold shares and purchased funds

Households’ net purchases in investment funds were similar to previous quarters, while net sales of directly owned shares were noted for the first time in more than a year. In the third quarter of 2021, households’ net purchases of other funds, which includes hedge funds and fund-of-funds, amounted to SEK 18 billion, while net sales of equity and bond market funds amounted to SEK 1 billion. During this period, households’ net sales of shares amounted to SEK 17 billion, following net purchases of shares throughout 2020 and the first six months of 2021. In the third quarter of 2021, households sold mainly Swedish listed shares, which resulted in net sales amounting to SEK 20 billion, making it the largest amount in net sales registered during a single quarter since the start of the time series in 1996.

Savings levels in new tenant-owned apartments were low

Households’ net purchases of new tenant-owned apartments amounted to SEK 6 billion, which is SEK 5 billion less than in the corresponding quarter a year ago and is the lowest figure in five years. Compared with the record-high figure in the fourth quarter of 2019, in which savings amounted to SEK 25 billion, this is a decrease by three-quarters. New tenant-owned apartments consist of apartments with changing rights of tenancy to tenant-owned apartments and newly produced tenant-owned apartments. Households’ assets in apartments amounted to SEK 3 245 billion at the end of the third quarter.

Households’ ownership of tenant-owned apartments is a financial asset and therefore is included in the Savings Barometer. One- or two-dwelling buildings with ownership rights are not included, since they constitute real assets. Information about households’ total assets in housing is available in the National Wealth. Read more about National Wealth under More information.

Annual growth rate of loans rose

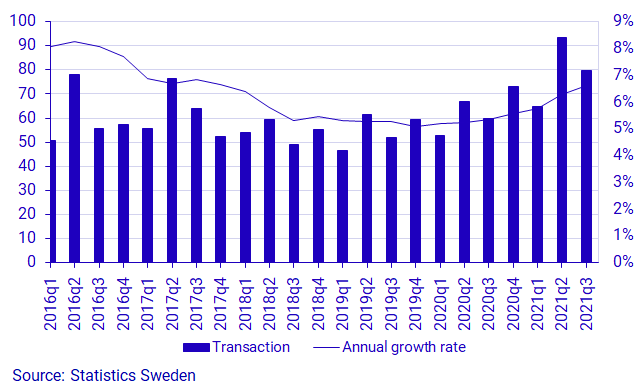

Households’ net borrowing, that is, new loans less amortisations, amounted to SEK 80 billion in the third quarter of 2021, which is SEK 20 billion more than in the corresponding period a year ago. Net borrowing has been high in recent quarters. This higher level of net borrowing can partly be explained by banks’ temporary relaxations on amortisation requirements that applied until the end of August. This has meant that some households have refrained from amortising loans.

The growth rate of households’ loans has increased consistently since the outbreak of the COVID-19 pandemic. The annual growth rate of loans was 6.6 percent in the third quarter, which is 0.3 percentage points more than in the previous quarter. Households’ loans, which consist primarily of loans in banks and housing credit institutions as well as student loans, amounted to SEK 4 935 billion at the end of the third quarter of 2021.

Financial net wealth increased

Households’ financial net wealth rose by 1.7 percent during the quarter and amounted to SEK 14 600 billion at the end of the third quarter of 2021. Financial wealth has risen sharply during the COVID-19 pandemic. A strong contributing factor to the positive progression has been the upturn in the stock market during the period, since a large part of households’ financial assets are share-related. According to the Affärsvärlden General Index, the stock market increased by 68 percent since the first quarter of 2020. Households’ net wealth increased by SEK 4 355 billion in the same period.

Definitions and explanations

Financial savings is calculated as the difference between transactions in financial assets and transactions in liabilities. The statistics are reported in current prices and do not take inflation into account.

No major revisions or methodology changes are published in the Savings Barometer. These are instead published in the Financial Accounts, in which there is more time for calculations and reconciliation with other sectors, and in which revision documentation is published. However, minor revisions can occur due to, for instance, revised primary statistics.

In connection with the publication of the Savings Barometer for the third quarter of 2021, the entire time series was updated from the first quarter 1996 onwards with the revisions introduced in the Financial Accounts’ publication on 23 September. In connection with the most recent publication of the Financial Accounts, new sources and methods for compiling statistics on debt securities, shares and funds were introduced.

More detailed descriptions of major revisions are described in the statistical news on Financial Accounts:

Financial accounts, quarterly and annual

For more information, see:

Nationalförmögenheten och nationella balansräkningar (pdf)

Statistical database;

Next publishing will be

2022-02-17 at 09:30.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.