Economic microsimulation:

Those with the lowest incomes are most affected by the 2017 central government budget

Statistical news from Statistics Sweden 2017-01-24 9.30

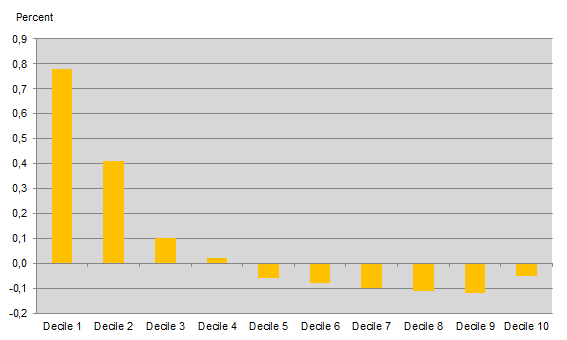

The central government budget contains a wide range of changes that affect household finances. Households with the lowest incomes will experience the largest change in their financial situation as a result of the changes in the central government budget. However, the differences are relatively small in all income groups.

The effect of the changes in the central government budget that affect household finances have been calculated using the FASIT simulation model.

Income thresholds for charging national income tax will not be raised, in accordance with regulations defined in the Income Tax Act, and the threshold for making deductions for travel to and from work will be raised. Both changes lead to increased tax. At the same time, the ceiling for deferred deduction will be removed, which will lead to reduced capital tax.

There are also changes among the non-taxable transfers. Child allowance and housing allowance will be raised for families with children, and housing supplement and the special housing supplement will be raised for individuals with sickness and activity compensation. The gender equality bonus will also be removed. Furthermore, the guarantee level for sickness and activity compensation will be raised.

Overall, households will hardly be affected at all by the changes implemented in 2017: the disposable income will decrease by SEK 432 million, which corresponds to 0.02 percent.

Households at different income levels are affected in different ways by the changes. The economic standard will decrease or remain largely unchanged for most people, but will increase for households with low incomes (first and second decile). Individuals whose sickness and activity compensation, housing allocation or housing supplement will be raised are those in low income groups, while people whose national income tax will be raised are in high income groups. People whose deferred deduction will be raised and whose taxes will therefore be decreased, are mainly those in the highest decile group, which means the decrease will be slightly smaller in this group.

Roughly half of the population is affected by the changes in some way, albeit to differing degrees. Among the ten percent with the lowest incomes, 37 percent will experience improvement and five percent will experience a change for the worse. Among the ten percent with highest incomes, however, only three percent will experience an improvement and 87 percent will experience a change for the worse as a result of the changes.

Definitions and explanations

Economic standard

The household's disposable income is used to measure the economic standard. To enable comparisons between different household types, the income is divided using a weight which is determined by the composition of the household. This equivalised income is used as a measure of economic standard.

Decile

Individuals are sorted by increasing incomes and are divided further into ten income groups of equal size (decile groups), in which the first decile contains individuals with the lowest incomes and the tenth decile contains those with the highest incomes.

FASIT

FASIT is a micro-simulation model, in which effects of changes in taxation, fee and transfer systems for individuals and households can be calculated.

Publication

More information is available in the publication Effects on household finances in the 2017 central government budget

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.