Real estate tax assessment in 2023

Property holdings assessed at SEK 14 300 billion

Statistical news from Statistics Sweden 2024-12-12 8.00

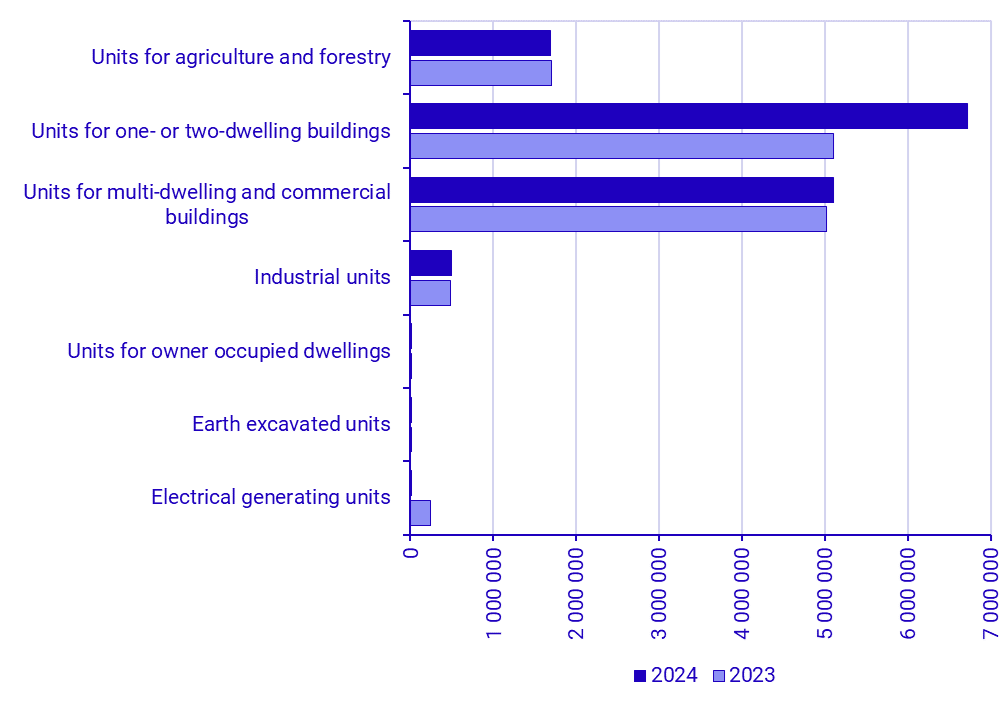

The assessed value of all taxable real estates in Sweden increased by SEK 1 699 billion, or 13.5 percent, in the 2024 simplified and special assessment of real estate. The total assessed value of all taxable real estate in Sweden is SEK 14 300 billion.

The increase of 31.5 percent for one- or two-dwelling building units is mainly due to the simplified assessment of this type of real estate carried out in 2024. The total assessed value for this type amounts to SEK 6 717 billion.

For other assessed units that have been subject to a special assessment, the change in tax values has been marginal. The total assessed value of agriculture and forestry units decreased by 0.4 percent. The total assessed value of multi-dwelling building and commercial building units increased by 1.5 percent. The total assessed value of Industrial units increased by 2.8 percent.

One- or two-dwelling buildings, built (type code 220), with the highest average assessed value, SEK 13 621 535, are located in Danderyd municipality. Buildings with the lowest average assessed value, SEK 263 363, are located in Åsele municipality.

| Total assessed value, million SEK | Number of assesed units | ||||

|---|---|---|---|---|---|

| Type of assessed unit | 2024 | 2023 | 2024 | 2023 | |

| Units for agriculture and forestry | 1 692 669 | 1 699 481 | 392 582 | 391 193 | |

| Units for one-or two- dwelling buildings | 6 717 402 | 5 106 612 | 2 488 488 | 2 480 655 | |

| Units for multi-dwelling and commercial buildings | 5 100 222 | 5 023 351 | 143 016 | 142 303 | |

| Industrial units | 503 754 | 490 021 | 171 200 | 168 709 | |

| Units for owner occupied dwellings | 8 014 | 7 250 | 4 359 | 4 003 | |

| Earth excavated units | 3 747 | 3 609 | 1 768 | 1 756 | |

| Electrical generating units | 255 667 | 251 973 | 5 984 | 5 826 | |

| Total | 14 281 475 | 12 582 297 | 3 207 397 | 3 194 445 | |

Definitions and explanations

The change figures reported compare the current year with the previous year. No adjustment has been made for any volume changes or structural changes. There may be new assessed units and assessed units may disappear between the years that may affect the change figures. There may also be structural changes for a assessed unit that may affect the change figures.

Statistical Database

More information is available in the Statistical Database

Feel free to use the facts from this statistical news but remember to state Source: Statistics Sweden.